What Millennials and Gen Z actually mean by "personalized banking"

Personalized banking and lending experiences are no longer a “nice to have” for financial institutions looking to compete in today’s marketplace. Consumers want financial providers who understand their needs on a personalized level — especially younger generations of Millennials and Gen Z consumers.

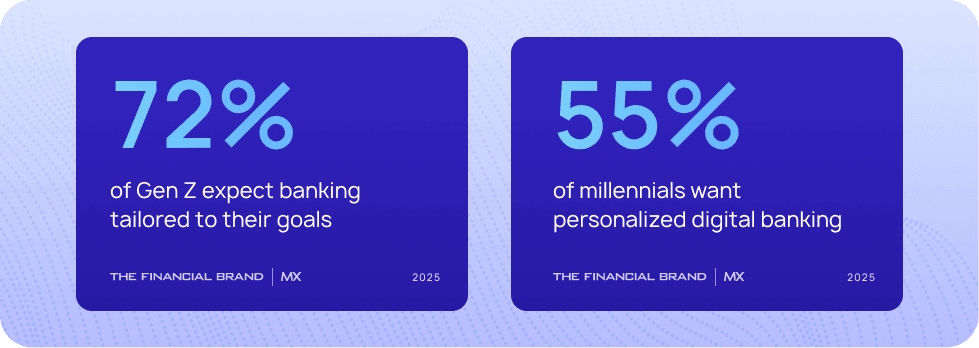

In fact, according to The Financial Brand, 72% of Gen Z expect banking tailored to their goals, while 55% of Millennials want a more personalized digital banking experience. But, this doesn’t just mean using their name on their account home screen or sending personalized marketing emails.

True personalization happens when banks consider individual customer needs at the product level. This is about infrastructure, not marketing campaigns.

In this post, we’ll explore:

- Why Millennials and Gen Z expect more personalization today

- What true personalized banking actually looks like

- Where banks typically fall short on personalization (and why)

- How to meet Gen Z and Millennial banking demands for personalized banking

- The modern lending infrastructure that makes true personalization possible

- What this means for lenders moving forward

Why Millennials and Gen Z expect more personalization (and why that matters now)

Today’s Millennial and Gen Z customers grew up in the age of the Internet, smartphones, social media, and streaming services. As a result, they have little patience for sub-par digital experiences and a growing expectation for personalized feeds and recommendations like the ones they enjoy from companies such as Netflix, Spotify, and Amazon.

If Instagram’s algorithm can learn and tailor the experience based on their behaviors, why can’t their bank do the same? And, increasingly, this isn’t just a desire or expectation for more personalized banking — it’s a demand. Recent research shows 66% of consumers expect greater levels of personalization than ever before, a 20-point increase from the previous year.

However, many financial institutions are still only delivering basic marketing personalization. Targeted offers for one-size-fits-all products will not fit the bill. And, the stakes to win and retain the loyalty of Gen Z and Millennial customers is higher than ever.

The Financial Brand says that “these two generations present an outsized market opportunity for regional and community financial institutions. Millennials, now aged 28-44, are at the life stage where they are adding mortgages, investment accounts, and other financial products, while Gen Zers, now aged 13-28, are beginning to form their first banking relationships.”

Coupled with the ongoing shift of trillions in assets as part of the great wealth transfer from older generations to their Gen Z and Millennial children, being able to meet their demand for personalized banking is critical.

What true personalized banking actually looks like

Here’s what we mean by truly personalized banking. It’s not about dashboard colors, birthday emails, or generic marketing campaigns. Instead, it’s about understanding customers on a truly personal level so that you can offer them products, tools, and services that meet them where they are and uniquely serve their needs.

Instead of a rigid credit platform, it could mean a more configurable credit platform using transaction-level credit™ technology that enables lenders to adjust to the life moments, circumstances, or needs of the customer. For example, a credit card offered to military members could have a card interest rate that can be adjusted when the primary cardholder goes on active duty. Or, a card could offer different rates for different merchant categories or locations — like a lower interest rate for transactions on groceries or other necessities when purchased within a 10-mile radius of the family’s home.

Instead of one-size-fits-all loan products that could lead to defaults, it could mean enabling personalized lending programs like flexible payment schedules for the gig worker who doesn’t have a set salary. It could mean allowing for temporary adjustments like skip-a-pay programs, shifting a payment due date, or offering a temporarily lower interest rate to accommodate life events that disrupt a borrower’s ability to pay.

Where banks typically fall short on personalization (and why)

To deliver on this type of true personalized banking, the challenge often isn’t lack of awareness, ideas, or motivation. It’s finding ways to create these personalized touchpoints into rigid product structures and manual configuration requirements in a timely and cost-effective way.

For example, data silos can make it difficult to generate timely, relevant insights or provide a consistent experience across all channels. Legacy technology is often inflexible and cannot seamlessly integrate with newer, API-based tools that enable faster, real-time insights and innovation. And, legacy systems require more manual work to reconfigure, slowing down the pace of innovation.

Bottom line: your biggest roadblocks to personalized banking are infrastructure constraints.

How to meet Gen Z and Millennial banking demands for personalized banking

Meeting the growing demand for personalization from Gen Z and Millennial consumers requires a modern infrastructure approach. Here are a few infrastructure capabilities to consider to enable personalized banking products and personalized lending programs:

Proactive, data-driven guidance: From reactive service to predictive partnership

Banks, credit unions, and lenders capture hundreds of data points about their customers every single day. But, most of that data sits in siloed internal systems or reactive reporting without being put into practice to drive personalized experiences for consumers.

By focusing on a unified data foundation and real-time data analytics powered by automation, financial providers can anticipate customer needs and act on those needs in a meaningful way. For example, low balance alerts could be a signal to offer a loan hardship program before a customer defaults on a loan.

Total control: Self-service as a loyalty driver

The vast majority of tech-savvy Millennials and Gen Z prefer self-service options to meet their needs and manage their accounts. In fact, one Gartner survey found 38% of Gen Z and Millennial customers are likely to give up on a customer service issue if they can’t resolve it in self-service. What’s more, Gen Z and Millennial customers said that if their issue could not be resolved in self-service they:

- Would use the service or product less (55%)

- Wouldn’t buy from that company again in the future (52%)

- Would say negative things about the company or product (44%)

This preference for self-service resolution is a significant opportunity for financial institutions — enabling consumers to solve their own needs and freeing up valuable call center resources to focus on more complex issues or tasks. With the right infrastructure to support, this could translate into higher customer satisfaction and significant efficiency gains. For example, Best Egg was able to redirect 78% of due date changes to Best Egg’s customer portal, significantly freeing up agent time.

Flexible products: Customizing credit for life stages

Our earlier examples of personalized lending solutions that adapt to changing customer needs may be the biggest infrastructure challenge for many financial providers to tackle. These flexible loan products require a highly configurable product engine where business teams can create variations without time-consuming IT project coding and implementation.

For instance, credit providers on legacy card platforms face issues every time they modify an account — requiring manual processes and the need to navigate through multiple separate software systems. By contrast, something like LoanPro’s end-to-end card platform enables card programs and individual accounts to be effortlessly modified through agent actions or automations.

The modern lending infrastructure that makes true personalization possible

Your modern lending infrastructure shouldn’t just focus on adding more features to outdated systems and inflexible products. The key is technology focused on enabling outcomes with a strong API-first architecture and data foundation.

API-first architecture

Instead of rigid systems that force you to change processes to match their limitations, an API-first platform can be configured to fit your needs and enable real-time data sharing between systems.

Configurable, API-first platforms allow lenders to adapt to changing requirements and integrate seamlessly with other business applications and systems. This enables omnichannel experiences that can meet customers where they are, faster innovation and time to market, and the flexibility to shift products as customer needs evolve.

Real-time data and automation

Personalized experiences and products are only as good as the data that powers them. But, most legacy solutions have data spread out between multiple systems, each with its own level of accessibility and out of sync with each other.

Modern lenders need a centralized, single source of truth for real-time data that can give them unprecedented visibility and control.Real-time data enables proactive guidance for consumers, instant approvals on credit and loans, dynamic credit limits, and expanded self-service options.

What this means for lenders moving forward

As Millennials and Gen Z enter their peak borrowing years, the banks and lenders that will win their share of mind and share of wallet are those who put product flexibility at the heart of their personalization strategies. The time is now to invest in a modern platform that enables the flexibility, personalization, and automation that today’s younger generations have come to expect and tomorrow’s future generations will demand.