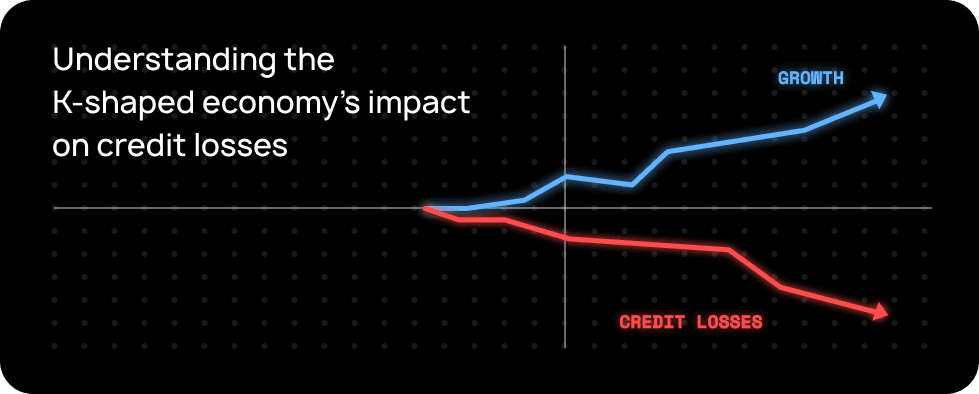

How to reduce credit losses by 38% in a K-shaped economy

While the term “K-shaped economy” first became top of mind during the COVID-19 pandemic, it is gaining even more traction in 2026 as economists warn this economic structure isn’t a temporary trend but a lasting reality.

In the simplest terms, a K-shaped economy is where different groups or industries experience two vastly different outcomes — some see wealth grow while others are falling behind. This K-shaped economy also highlights a widening economic inequality among high-income households and low-income households.

Why does this matter for lenders? A K-shaped economy makes credit risk management even more important than ever as more borrowers may fall into financial distress. In addition, lenders cannot rely on a one-size-fits-all approach to managing credit risk when borrowers may have very different economic outlooks.

In this post, we’ll dive into how a K-shaped economy impacts credit losses and proven strategies to reduce credit losses.

Understanding the K-shaped economy's impact on credit losses

A K-shaped economy doesn’t necessarily create more credit risk. It simply concentrates it. As some borrowers get stronger, others face increasing inflation, costs, and debt that weakens their ability to repay a loan.

This requires lenders to manage credit risk in new ways. When economic pressure hits some consumers harder than others, blunt approaches like cutting off anyone below a blanket credit score just push good borrowers out while doing nothing to stop losses.

Smarter credit risk management leverages a dynamic, data-rich, and continuous platform to spot which customers are slipping and why and enable lenders to take action before loan delinquency occurs.

The true cost of credit losses in unsecured lending

The real cost of credit losses isn’t just what a lender writes off. It’s a compounding effect of delayed action, misclassified risk, and missed opportunities to keep good borrowers on track — all of which are magnified when economic conditions pull different borrowers in opposite directions.

In a K-shaped economy, those costs become even more lopsided. Losses don’t trickle in evenly across a portfolio. They pile up in specific borrower segments that are under sustained financial pressure. Meanwhile, healthier borrowers continue paying on time, which can make overall performance look deceptively stable. By the time losses finally show up in portfolio-level metrics, they’re already deeply embedded and far more expensive to unwind.

And, when lenders rely on static risk controls, they often tighten credit or cut off borrowers who are still viable but temporarily strained. That not only shrinks future revenue, it pushes customers toward higher-cost or riskier alternatives — increasing the odds they won’t recover.

Why legacy systems make loss prevention harder

Traditional legacy credit risk frameworks aren’t built to manage the speed, complexity, and volatility of today’s marketplace. Lenders need a modern credit risk management framework that helps reduce credit loss using real-time data, automation, and forward-looking thinking. Here’s why legacy systems fall short on consumer lending risk management today:

Legacy systems rely on backward-looking signals. Legacy credit models are built around credit scores, bureau data, and periodic account reviews. That doesn’t work in a K-shaped economy and doesn’t consider newer types of borrowers like gig workers.

Legacy systems take a blanket approach to managing risk. Legacy systems rely on set triggers that don’t consider the context. For instance, they don’t distinguish well between a customer who missed a payment because of a short-term challenge and one who is sliding into long-term financial distress. That means lenders end up responding with a blunt tool that pushes recoverable borrowers into default instead of finding ways to get them back on track.

Legacy systems move too slow. Most traditional credit risk management processes rely on manual, batched reviews and reassessments. If systems can’t see and act on changes in near real time, lenders will always be playing defense, and usually losing.

Legacy systems can’t connect the dots across systems. Legacy technologies are siloed and can’t provide lenders with unified access to data. That means early warning signs — changes in spending, payment behavior, income volatility, support interactions — never get pulled together into one risk picture.

Want to learn more about how you can evolve your legacy processes with modern credit risk management strategies? Read the full credit risk management guide.

A data-driven framework for reducing credit losses by 38%

Here are four proven levers that lenders can use today to reduce credit losses using a modern, data-driven credit risk management framework.

Lever 1: Early warning systems and real-time monitoring

In a K-shaped economy, the biggest losses don’t come from borrowers who suddenly disappear, they come from borrowers who slowly drift into trouble. Real-time monitoring looks beyond monthly payment status and tracks changes in cash flow, spending patterns, payment timing, income volatility, and account behavior as they happen.

This type of automated early warning system lets lenders spot stress while it’s still small instead of waiting for a 30-day loan delinquency notice. And, more importantly, it enables lenders to take action that proactively engages borrowers before it’s too late and prevents loan delinquency before it happens.

Lever 2: Flexible hardship programs that drive repayment

Not every struggling borrower is a bad risk. Sometimes, they just need a little help to get through a rough patch. Flexible hardship programs give lenders a way to separate temporary stress from a true inability to pay. Instead of turning immediately to collections, hardship relief and repayment programs can help customers stay engaged and current on their account amid financial difficulty.

Lenders can offer options like payment deferrals, short-term reductions, or modified schedules that reflect what the borrower can actually afford right now. This not only prevents delinquency, it can also translate into greater long-term profit and trust as borrowers who feel supported are far more likely to re-engage and resume paying.

Case in point: LoanPro client Best Egg launched two complementary hardship programs within just two months during the COVID-19 pandemic. This significantly reduced the probability of delinquent loans by creating new options for Best Egg’s customers. Learn more about how Best Egg did this below.

Lever 3: Real-time loan modifications that prevent defaults

This lever goes hand in hand with the early warning signals and flexible hardship programs mentioned above. Lenders need to be able to modify loans in real time to capitalize on continuous monitoring and flexible programs that keep borrowers on track during financial stress.

When a system detects rising risk (a missed payment, income disruption, or a sudden increase in utilization) it can proactively offer tailored changes before the account tips into delinquency. This might mean extending a term, adjusting a payment date to match payroll, or temporarily lowering a payment. Small, timely changes keep loans viable and dramatically reduce the likelihood that short-term stress turns into a permanent loss.

Lever 4: Enhanced fraud detection at origination and servicing

In a stressed economy, fraud and credit losses start to blur together. Synthetic identities, account takeovers, and first-payment defaults can look like normal delinquency unless you’re watching for them. Modern fraud detection uses behavioral data, device intelligence, and transaction patterns to flag bad actors early. Both when a loan is opened and throughout its life.

That matters because every fraudulent account distorts your risk models and inflates your loss numbers. Stopping fraud upstream doesn’t just prevent direct losses, it keeps your portfolio data clean, so your credit decisions get smarter instead of noisier.

To learn more about proven strategies to better manage credit risk in 2026, we're hosting a webinar with industry expert Kevin Moss, the former Chief Risk Officer at SoFi and Wells Fargo. Register below to see how leading credit providers are preparing to meet the challenges of a K-shaped economy.

Case study: How Best Egg decreased default rates

Best Egg is a leading financial confidence platform that offers flexible solutions to help consumers with limited savings to navigate their everyday financial lives. They provide a growing suite of products such as personal loans, credit cards, flexible rent, and financial health tools.

Best Egg is known for its superior customer service in consumer lending, recognized by J.D. Power for overall customer satisfaction among consumer lending for two years in a row. The company’s care and attention to helping borrowers has helped it keep satisfaction high amidst market changes and decrease default rates among stress borrowers. Here’s how Best Egg worked with LoanPro to reduce default rates by 38% with flexible hardship programs and streamlined payments and collections.

Rapidly deploying hardship programs to reduce borrower defaults

The COVID-19 pandemic brought unique challenges as Best Egg’s payment extension rate went from 4% to 14% overnight. By partnering with LoanPro, Best Egg was able to quickly adapt to better support their customers by implementing automated loan adjustments based on new regulations, payment plans, and hardship programs in record time.

Within 60 days, Best Egg quickly utilized LoanPro’s configurable platform to launch a skip-payment option for borrowers experiencing hardships. While other lenders were still planning what to do, Best Egg delivered nearly instant peace of mind to its personal loan customers, who saw that their financial challenges met with flexible solutions. This helped significantly reduce the probability of delinquent loans by creating new options for evolving borrower challenges.

Best Egg also implemented self-service hardship enrollment through interactive voice response (IVR) and LoanPro’s API automation features to ensure Best Egg’s agents weren’t overwhelmed by hardship requests so they could focus their attention on more complex situations. Best Egg’s borrowers simply requested to enroll in a payment plan or to skip a payment. Both options were available via the IVR and the borrower portal, which sent the request to LoanPro’s API to complete the request.

Reducing default rates through streamlined payments and collections

Best Egg frequently struggled with late files, incorrect information, or broken remittance processes with its previous third-party payment processing platform. This ongoing challenge affected default rates, increased regulatory risk, and damaged relationships with Best Egg’s customers.

To resolve these issues and decrease default rates, Best Egg turned to LoanPro’s Secure Payments product to optimize its payment and collections process. Secure Payments is a hub for payment processors that stores payment profiles in accordance with PCI compliance so lenders can facilitate loan repayment with their chosen payment processor.

With LoanPro, Best Egg has centralized all payment profiles, driving compliance and lower default rates by increasing payment flexibility. Now, Best Egg and its customers can take advantage of a single source of truth using LoanPro’s API-first architecture to better manage payments and payment flexibility programs.

For example, Best Egg wanted to enable customers to enroll in its biweekly payment optionality program via the customer portal to avoid overloading agents. However, before a customer can sign up for biweekly payments, they need to be current on their loan to avoid being caught in a perpetual delinquency loop. Using LoanPro, Best Egg can easily inform customers how much they need to pay on their loan before they can enroll in the biweekly payments program.

Want to see more of Best Egg’s proven results in action? Read the full case studies below for the expanded narratives and stats:

How LoanPro technology makes reduced credit losses possible

Best Egg is just one of the hundreds of lenders who turn to LoanPro to help them deploy modern credit risk management programs and best practices.

For example, automatic payment adjustments and hardship programs are easily configurable with LoanPro’s Automation Engine and custom tagging functionality. Companies like Best Egg can define specific loan criteria to be eligible for payment adjustments and then, leverage our API-first platform to enable borrowers or frontline staff to make payment adjustments and enroll in hardship programs.

Ready to see how LoanPro can help reduce credit losses by 38% or more? Request a demo today.