Switch from your legacy system to the only scalable, API-first credit platform

Come see why our average time to take a customer live is three months. From an expert team to seamless contract migration, LoanPro will help you meet your go live timeline.

The platform with the stats to prove it

No other platform enables faster go-live timelines than LoanPro.

400+

Million API calls per month

2,000+

Unique credit programs launched

600+

Customers live on the platform

50+

Ready-to-go integration partners

3

Months average time to go live

92

Client Net Promoter Score

Partner with the pros

With decades of experience handling technical questions and unique end-user challenges, LoanPro’s experts will guide you through migration, launch, and growth.

Dedicated support

Dedicated consultants act as an extension of your team.

Open communication

Reach us through Slack channels, video conferencing, or your methods of choice.

Collaborate for strategic growth

Launch new credit products in just weeks, unlocking growth and scalability.

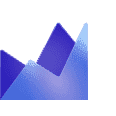

A unified platform to launch any credit program imaginable

Modern Lending Core

A reliable foundation that tracks all life cycle events in our Real-Time Ledger while Compliance Safeguard keeps you in the loop as regulations change.

Origination Suite

Increase your conversion rate from applicants to funded loans with our configurable origination workflows.

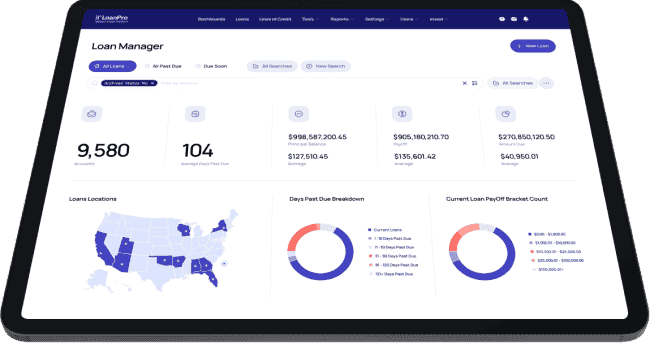

Servicing Suite

Increase operational efficiency by automating servicing in the background, reducing strain on agents and empowering customers to self-service their accounts.

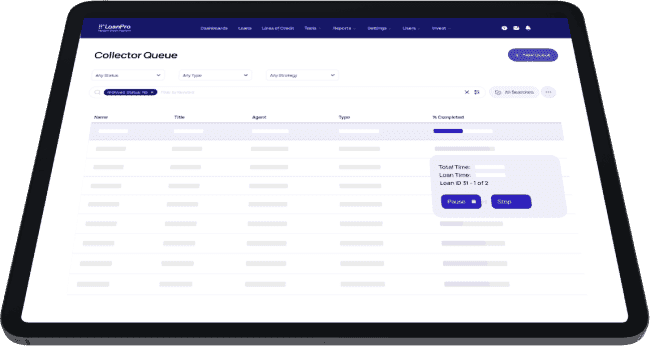

Collections Suite

Decrease default rates by providing payment flexibility and hardship programs for customers who are past due on payments.

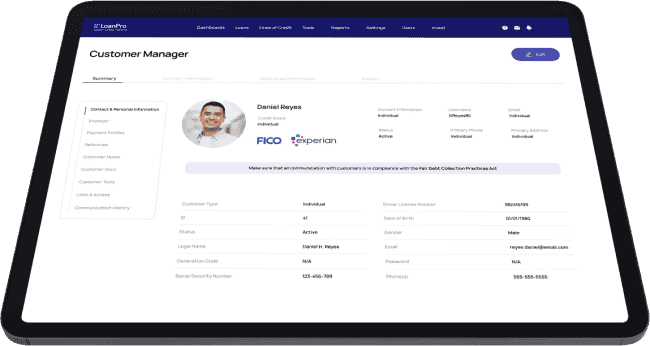

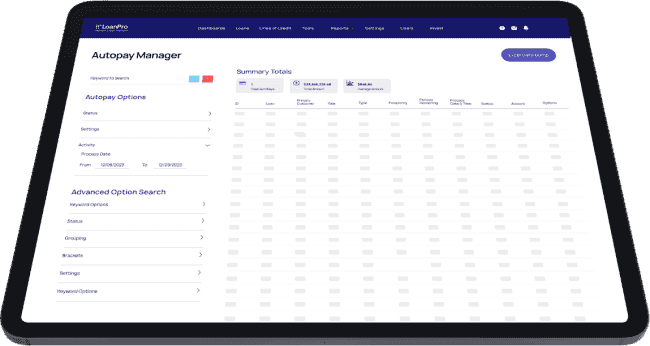

Payments Suite

Increase repayment rates by providing the ultimate payment flexibility with any payment method imaginable.

Bring your products to life with our API-first platform that provides ultimate configurability

Choose from pre-built financing models or create custom products on the LoanPro platform.

Contract migration

Seamlessly recreate credit products and accounts from your previous system.

Template library

Access a ready-made, fully compliant library of process workflows for every type of lending.

Partner integrations

Easily integrate with your favorite partners through our modern API.

Upgrade with ease with seamless migration

Your legacy system has given you enough headaches. Let LoanPro make the transition easy.

Expert team

Work with our expert migration team to move your operation with ease.

Migration tools

Migrate accounts in bulk from legacy systems into LoanPro’s API-first lending platform.

Go live timeline

Go from sign up to launch in an average of three months.

What our 600+ customers say about LoanPro

Kryspin Z.

FinTech Developer

Cloud based Loan Solution, scalable in performance and cost, Turnkey to Full API, Fast Implementation! I was searching for a loan servicing package for an loan onboarding and servicing implementation. Built from ground up on Amazon's cloud, LoanPro is a first-class Platform for Loan Servicing.

Tyler D.

President/CEO

The team at LoanPro has been remarkable to work with. This software allows us to bring all of our documentation and portfolio management into one location. It has been easy to set up and with great support from the team at LoanPro.

Evan C.

VP of Strategy

We’ve been able to automate large portions of our servicing center workflow, which is helping us realize meaningful savings as we scale. The LoanPro support team is very knowledgeable about the product and was instrumental in getting our organization up to speed post-integration.

With ultimate configurability and an API-first infrastructure, LoanPro supports virtually any class of financing product

Installment loans

Create unique personal installment loans to differentiate in a crowded market.

Credit card

Launch a consumer credit card that is attractive beyond merely a rewards program.

Unlock growth and go live quickly with LoanPro.

Talk with our team about how to make the switch today.