Auto lenders

Drive operational efficiency while accelerating growth and innovation

Challenges for auto lenders today

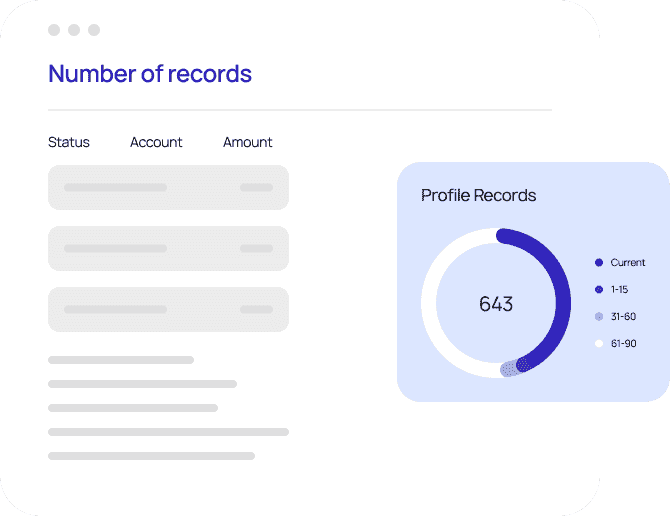

Rising delinquency rates

Delinquency rates on auto loans have risen over 30% in the last year

Manual processes

Agents are stuck manually servicing accounts, costing time and money

Disjointed systems

Key tasks are handled out of separate tools, with limited communication between systems

Negative consequences of challenges

Increased cost of capital

Extending loans is more expensive and riskier than ever, with default rates impacting your ability to get more capital

Diminishing margins

Every minute spent on servicing, collections, and back office inefficiencies decreases profits

Poor borrower experiences

Working out of disconnected systems makes life difficult for your borrowers, agents, and back office

The value that 600+ lenders achieve through LoanPro’s modern lending and credit platform

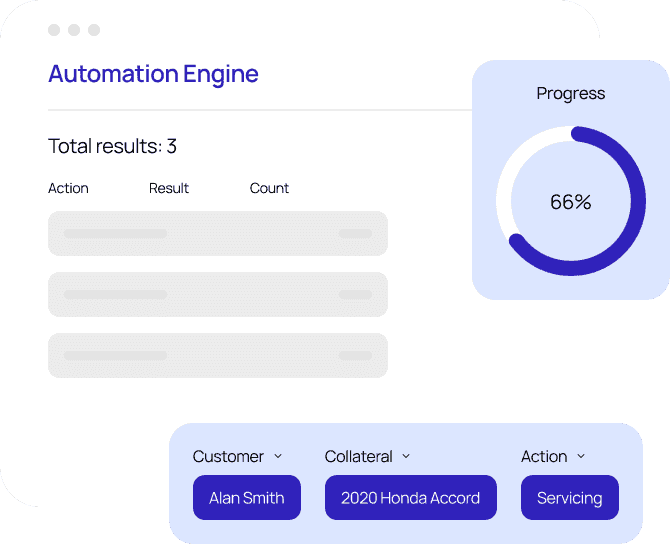

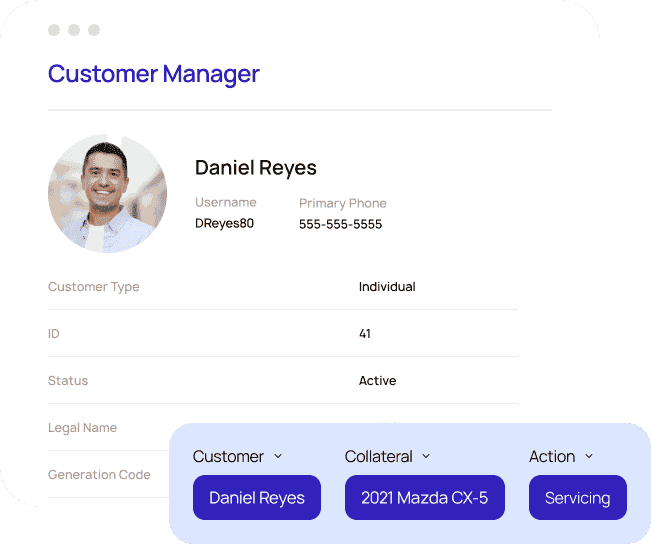

Increase operational efficiency with custom automations and auto lending guided workflows

- Embed your business logic into LoanPro’s Automation Engine to service accounts in the background

- Streamline and automate processes like contracting, communication, and repossession

Acquire new customers through increased efficiency

- Seamlessly integrate your origination partners into LoanPro’s modern API to form a single, cohesive system

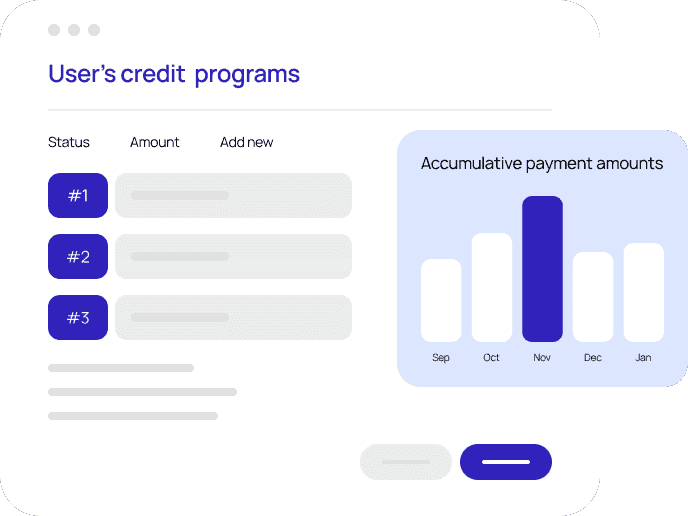

- Launch differentiated credit products, such as a line of credit based on a car’s current market value

Establish customer loyalty through a best-in-class borrower experience

- Provide a delightful experience that encourages borrowers to return for future lending needs

- Automation Engine services lending and credit products before customers even notice

Reduce risk of defaults and regulatory fines

- Use hardship programs to keep struggling borrowers engaged instead of dropping off

- Compliance Safeguard keeps your operations aligned with ever-shifting regulations

How LoanPro

solves the problem

for auto lenders

Modern Lending Core

Handle auto loans, leases, lines of credit, and other innovative products through a unified lending platform

Origination Suite

Approve more consumers for auto loan and credit products through complete configurability

Servicing Suite

Streamline insurance updates, repossessions, and other tasks with automations and guided workflows

Collections Suite

Communications, hardship programs, and more that build a high-performance auto loan portfolio

Payments Suite

Automate the payment process through PCI-compliant ACH, debit, and credit payments

Launch any unique auto-related loans, lines of credit, and credit cards on one platform to drive growth

Installment loans

Create unique auto installment loans to differentiate in a crowded market

Lease

Create lease opportunities with buy now, pay later for auto parts, car upgrades, and more

Line of credit

Launch a line of credit tied to a car's current market value, or use flexible settings to create other unique line of credit products

Credit card

Upsell your customers with a differentiated credit card to expand your customer lifetime value

Custom

Have a unique idea? Launch any lending and credit construct imaginable using LoanPro

What our 600+ customers say about LoanPro

Why partner with LoanPro

The only lending platform at the intersection of innovation and scalability.

Innovate Quickly

- Configurable end-to-end platform

- Pre-configured templates for all classes of loans

- API-first to integrate with existing tech stack

Scalable Growth

- Launched over 2,000 credit programs

- 25M+ active loans on LoanPro

- Launch compliant loan modifications in days

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

Build a high-performing auto lending portfolio with LoanPro today

Talk with our team about LoanPro’s modern lending and credit platform.