Consumer lenders

Innovate faster to drive scalable growth in lending and credit

Challenges for consumer lenders today

Ever-changing lending laws

Staying compliant is never simple in an uncertain regulatory environment.

Manual processes

Agents are stuck manually servicing accounts, costing time and money.

Rising default rates

Default rates on unsecured personal loans have grown by 38% in the last year.

Negative consequences of challenges

Increased regulatory burden

Entire teams research legal changes and develop complaint procedures.

Diminishing margins

Every penny spent on servicing, collections, and back office work decreases margins.

Increased cost of capital

Extending consumer loans is more expensive and riskier than ever.

The value that 600+ lenders achieve through LoanPro’s modern lending and credit platform

Increase operational efficiency with custom automations and guided workflows

- Put manual processes into guided workflows, streamlining servicing processes.

- Embed your business logic into LoanPro’s Automation Engine to service loans in the background.

Drive meaningful growth by launching differentiated credit products

- Launch any loan, line of credit, or credit card configuration imaginable.

- Launch new products in just three weeks.

Retain existing customers with a best-in-class borrower experience

- Automation Engine services lending and credit products before customers even notice.

- Configurable loan hardship programs that help customers in difficult situations.

Reduce risk of defaults and regulatory fines

- Use hardship programs to keep struggling borrowers engaged instead of dropping off.

- Compliance Safeguard keeps your operations aligned with ever-shifting regulations.

How LoanPro

solves the problem

for consumer lenders

Modern Lending Core

Enable innovation through an API-first architecture to support unique loan programs.

Origination Suite

Increase your conversion rate from applicants to funded loans through highly configurable origination.

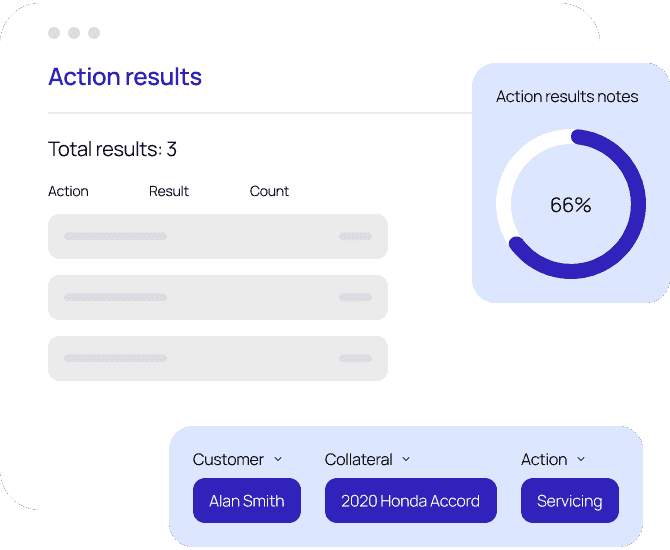

Servicing Suite

Streamline servicing tasks with automation and guided workflows.

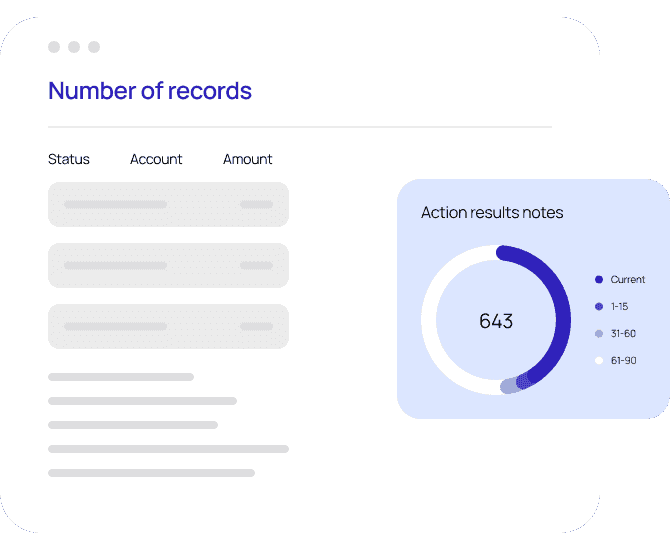

Collections Suite

Communications, hardship programs, and more that build a highly performant loan portfolio.

Payments Suite

Automate the payment process through ACH, debit, and credit payments with PCI compliance.

Launch any class of loan, line of credit, or credit card on one platform

Installment loan

Create unique personal installment loans to differentiate in a crowded market.

Line of credit

Build lifelong relationships with borrowers via a line of credit that remains indefinitely.

Credit card

Launch a consumer credit card that is attractive beyond merely a rewards program.

What our 600+ customers say about LoanPro

Why partner with LoanPro

The only lending platform at the intersection of innovation and scalability.

Innovate Quickly

- Configurable end-to-end platform

- Pre-configured templates for all classes of loans

- API-first to integrate with existing tech stack

Scalable Growth

- Launched over 2,000 credit programs

- 25M+ active loans on LoanPro

- Launch compliant loan modifications in days

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

Start innovating with LoanPro today

Talk with our team about driving innovation for your

organization today or receive access to our knowledge base.