Unveiling Transaction-Level Credit: Patent-Pending Innovation to Revolutionize Credit Infrastructure

Looking at the credit card market today, you quickly find a lot of credit card programs that are essentially identical with little differentiation through rewards programs. All credit card products on the market today are built on the same core systems, and offer the same basic financial mechanisms to borrowers, painted over with superficial differences in their rewards points or cash back. There’s little room for innovation or personalization because the underlying product is rigid, held in place by inflexible technology. This inflexibility changes today.

Infrastructure Driving Personalization: Transaction-Level Credit

As it stands, more or less every card program provides three things:

- The ability to make purchases

- The ability to transfer balances

- The ability to receive a cash advance

The rules for transactions are set and unchangeable, meaning that interest for every purchase accrues at the same rate. Balance transfers all offer the same interest abatement, and interest starts to accrue immediately and at the same rate for all cash advances. The current state makes it impossible to differentiate credit products, which is why the products with the largest marketing budget typically win.

LoanPro looked at this problem and began asking questions:

- Why does it work that way?

- How should it work?

- What’s best for consumers?

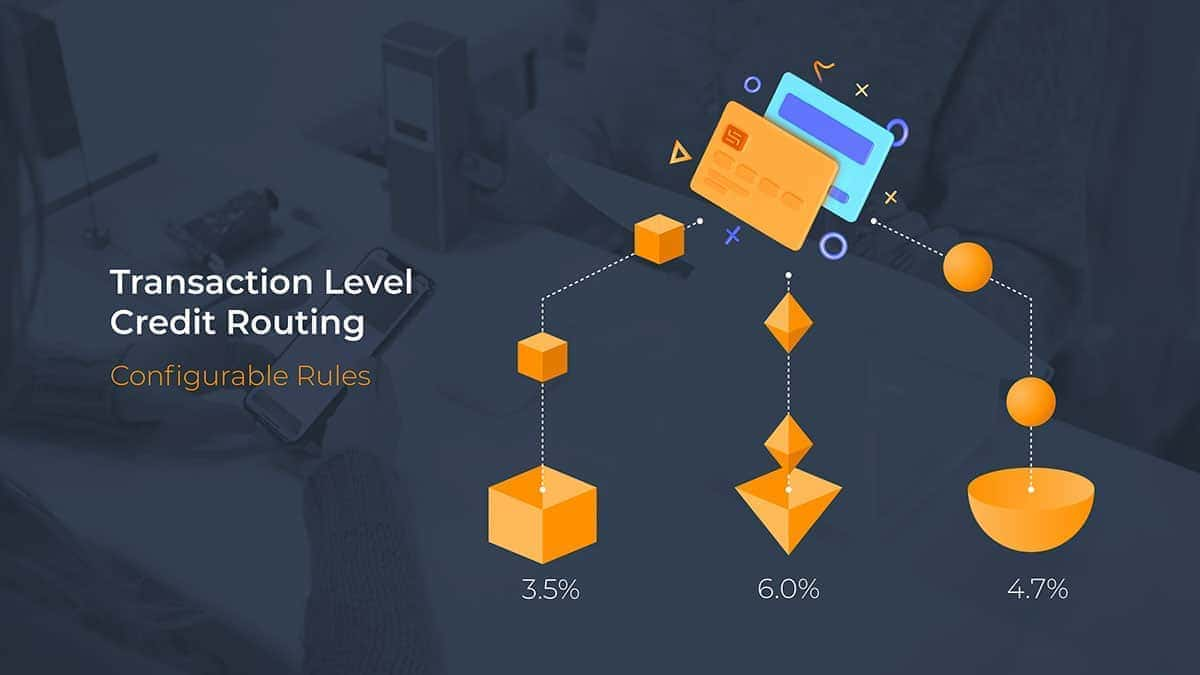

After evaluating the entire credit industry, we determined that instead of three rigid separations, we should provide the flexibility to create unlimited groups. We consider transactions individually, and use specific transaction attributes to categorize them. We built customization tools that allow companies to assign transactions to those groups based on their own business logic, and then offer unique finance terms to each group.

This train of thought allowed us to build our patent-pending new innovation, transaction-level credit. Here’s a deep dive into how this innovation works.

When a new card transaction is attempted, we cleanse, categorize, and classify it to extract information such as the category, geolocation and merchant name associated with the purchase. Based on this new information, you’re able to create unique rules to decide which transactions are approved and denied.

After approval, you’re able to take this one step further by creating unique groups or buckets to which transactions are allocated. These groups can be specific to an individual transaction or a broader category of potential transactions. Then, unique terms for the group (such as interest rates, abatement periods, group balances, and finance charge calculations) can be applied to each transaction administered by LoanPro’s real-time credit ledger.

Learn more about transaction level credit: Schedule a time

What use cases does transaction-level credit empower?

So, what does this mean, and what kinds of products does transaction-level credit enable? Here are a few examples:

Program Example #1: A single credit line offered to a family with multiple linked cards, one for each family member. Each card can be subject to different rules, like different spend or single transaction limits. Cards can also be restricted to specific purchases or purchase types. Maybe the family decides the youngest child should buy his own clothes, but shouldn’t be allowed to buy video games. So, they set the correct rules to ensure the right behavior. Purchases by the youngest child are broken out into a group so he and his parents can see exactly how much he spends and how much interest his purchases accrue. As he grows, his parents can change the rules to meet his unique needs. Meanwhile, different rules can be set for each card, so parents and older siblings have more freedom with their purchases.

Program Example #2: A card designed for small business owners. This card offers abated interest when inventory items are purchased, and low interest rates on equipment purchases. When businesses sign up for the card, they specify categories for each. A construction company decides their ideal is to buy lumber 60-days interest free, and get a low interest rate when they buy tools. A restaurant decides to use their interest abatement on food, and opts to get a lower interest rate when they buy kitchen equipment.

Program Example #3: A consumer card offered to military members. The card interest rate can be adjusted when the primary cardholder goes on active duty. A big problem that members of the military face is that when they go on deployment, their family back home may have other relationships with financial organizations that they develop. To bump a specific card to the top of the family’s wallet, you need to show that you care about them and understand what they’re going through. Consequently, you can provide lower interest rates for groceries or other necessities when purchased within a 10-mile radius of the family’s home. Additionally, you can provide reduced interest on phones and other communication tools that help families stay in touch while a loved one is serving.

These are just three innovative examples of programs that are possible only with transaction-level credit, but even little things can differentiate a more typical program. For example, the card program covering a purchase of up to $10 of Baskin Robbins ice cream when purchased within the week of the cardholder’s birthday. Consumers want a card that fits them, and they need finance to feel much more personalized than it is today.

Credit Infrastructure

Transaction-level credit is available today as a functionality of LoanPro’s infrastructure for credit card and line of credit programs. LoanPro is combining our real-time credit ledger, best-in-class card servicing and card management features, and direct integrations to the top card issuer processors—all with the goal of lowering the barrier to entry for any company that wants to enter the lending and credit space or improve their existing programs. In turn, this innovation empowers our clients to help their own borrowers, giving them tools to increase financial literacy, see their account with more transparency, and gain insight into how their financing works.

Want to learn more about how transaction-level credit can differentiate your products? Click here to chat with a member of our team.