Your guide to understanding crypto-backed lending opportunities

The crypto-backed lending market reached a new all-time high, hitting $73.6 billion in Q3 2025. This type of lending enables crypto holders to borrow cash (fiat or stablecoins) using their Bitcoin, Ethereum, or other digital assets as collateral.

Crypto-backed lending presents tremendous opportunities for traditional lenders and fintechs. However, crypto lending requires fundamentally different infrastructure than traditional lending.

While the opportunity is real, so are the operational requirements. In this post, we’ll tackle:

- Why lenders are entering crypto-backed lending

- What makes crypto lending different (and why it matters)

- Infrastructure requirements and why traditional lending software won’t work

- A pragmatic path to launching crypto-backed lending

The opportunity for crypto-backed lending

So why are lenders entering crypto-backed lending? It enables them to meet customer demand, capture new revenue streams, and leverage the efficiency of digital assets as collateral.

Consumers, particularly high-net-worth individuals and tech-savvy younger generations, want the liquidity that crypto-backed lending offers by enabling them to unlock value from their crypto holdings without selling them.

In addition, crypto-backed loans are often approved and funded more quickly than traditional loans, do not require traditional credit checks, and can often offer lower interest rates as loans are over-collateralized (i.e., more crypto is deposited as collateral than what is borrowed).

In addition to meeting these demands, crypto-backed lending opens up additional revenue streams for lenders from loan interest and cross-selling of related services like crypto custody and trading. And, because cryptocurrencies can be liquidated in real-time, lenders can significantly reduce risk.

Companies who offer crypto lending typically fall into one of two types: centralized finance (CeFi) and decentralized finance (DeFi) platforms:

- Centralized finance lenders serve as intermediaries, similar to banks, between borrowers and lenders.

- Decentralized finance platforms operate on blockchain technology and use smart contracts (i.g., to facilitate transactions. This allows users to maintain control of their assets and can often get better rates by eliminating a centralized authority and enabling peer-to-peer transactions.

What makes crypto lending different (and why that matters)

Digital assets in lending makes it possible for consumers to access cheaper, faster, and more accessible means to get a loan. But, cryptocurrency has been defined by big gains and big losses. And, this volatility holds true when it comes to crypto-backed loans. For instance, after reaching an all-time high of $126K in October 2025, bitcoin fell as low as $84K in early December 2025.

The extreme and rapid swings in pricing for digital assets can significantly impact loan collateral, creating very specific operational needs that traditional lending platforms don’t face.

The reality is that traditional collateral — cash, real estate, etc. — is stable. Crypto, by design, is not stable. And, traditional lending software is not built to handle the real-time, dynamic pricing models of crypto collateral.

What crypto lending infrastructure actually requires

Simply put, crypto lenders need a system built for modern financing that can be adapted and scaled over time to fit changing needs. Real-time processing instead of batch processing. Smart automation instead of manual workflows. Dynamic pricing models instead of static values.

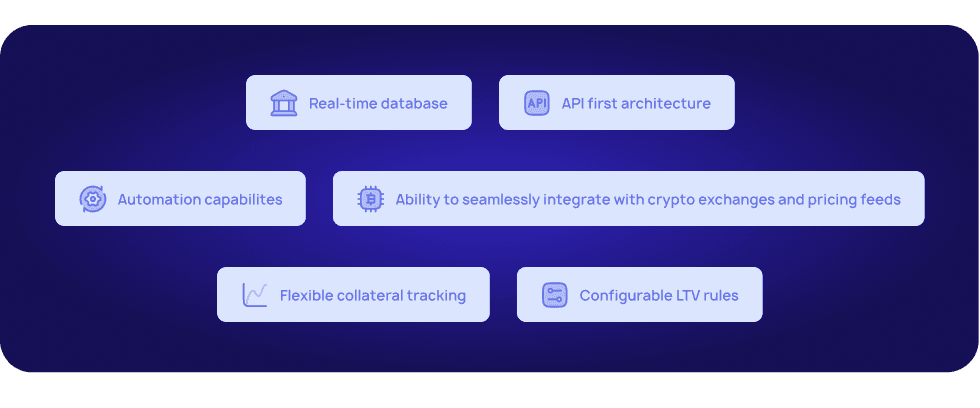

A crypto lending platform needs to be able to handle the robust technological requirements, and sophisticated risk management and compliance of crypto’s inherent volatility. Some of the core technology requirements to consider when evaluating crypto lending software include:

- Real-time database: Real-time crypto lending databases provide live data on lending/borrowing rates, Total Value Locked (TVL), liquidations, and crypto wallet activity.

- API-first architecture: API-first platforms treat the API as the core product. This enables lenders to innovate faster by reconfiguring and assembling existing API components, improve scalability and flexibility, and ensure every feature is accessible through an API endpoint.

- Ability to seamlessly integrate with crypto exchanges and pricing feeds: Lenders should be able to leverage APIs from providers to gain access to real-time data, order execution, and historical info. This doesn’t just mean native integrations with exchanges but instead, enabling flexible API integrations to the tools like crypto exchanges and pricing feeds.

- Automation capabilities: Automation is critical in a fast-moving crypto environment. Lenders should look for automation capabilities such as smart contracts to automate loan origination, interest calculation, and collateral management.

- Flexible collateral tracking: Flexible collateral tracking systems allow borrowers to manage loan positions and LTV ratios in real time, providing more control and strategic options compared to traditional loans.

- Configurable LTV rules: Being able to configure LTV rules is critical for risk management, allowing lenders to set risk thresholds for collateral that can trigger automatic rules as mentioned above.

LoanPro’s modern credit platform is one example of the type of architecture crypto lenders may use — leveraging LoanPro’s real-time database and API to connect lending and credit operations to crypto exchanges.

Ready to streamline and scale your crypto lending? Download our one-pager to see how LoanPro can help.

A pragmatic path to launching crypto-backed lending

For any lender or fintech looking to get started with crypto-backed lending, the key is to test small and build over time. We recommend a conservative approach at first to minimize risk.

Just look at the crypto failures of 2022 as your cautionary tale. Risky investments, unsecured loans, and poor risk management led to significant customer losses and widespread bankruptcies. When some of the biggest crypto players went bankrupt, including BlockFi, Celsius, Genesis, and Voyager, crypto lending collapsed as mismanaging risk and the acceptance of toxic collateral from borrowers hit lenders.

To minimize the risks of this extreme volatility case, modern lenders should look to over-collateralized, stablecoins first to ensure any pricing fluctuations don’t create undue risk. In addition, look for regulated custodians and set conservative triggers. By testing small, lenders can create a crypto lending platform that can handle more risk and more volume over time.

Bottom line: the crypto-backed lending market opportunity is real, but it requires the right purpose-built infrastructure. Lenders that are winning today in this space aren’t forcing old systems into new use cases. Instead, successful crypto lenders are turning to API-first crypto lending platforms that can scale and adapt.