What is Model Context Protocol?

It’s clear that AI is transforming lending in 2025 — with promises of faster decisions, lower costs, and expanded approval rates. As organizations look to adopt artificial intelligence in lending and servicing, the term "Model Context Protocol" is likely top of mind for many. But, what is it really and why does it matter for lenders?

In this post, we’ll outline:

- What is Model Context Protocol?

- The AI integration problem every lender has right now

- What Model Context Protocol actually is

- Three problems MCP solves that custom integration can't

- How lenders are using MCP in real operations

- Why LoanPro built the only MCP for lending

- Ready to deploy AI without the integration nightmare?

What is Model Context Protocol?

In a nutshell, the Model Context Protocol (MCP) is an open-source standard for connecting artificial intelligence (AI) models to external systems, tools, and data sources. One of the best analogies to understand MCP is to think of it like a USB-C port for AI applications.

Just as a USB-C port provides a standard way to connect electronic devices—plugging in a charger to a laptop, connecting your monitor, powering your Bluetooth speaker, linking your external hard drive, syncing your smartphone, or charging your AirPods. Instead of a unique proprietary plug for every single electronic device, USB-C ports make it easier for any electronic device to connect.

MCP acts as that USB-C port to enable various AI applications and tools to “plug in” to data sources and tools. LoanPro recently launched its MCP gateway to safely allow LoanPro clients and partners to begin testing and developing AI-powered credit servicing and collections initiatives. Now, lenders can leverage their own USB-C port for modern credit AI integrations and innovation.

The AI integration problem every lender has right now

Previously, every single AI integration would take months of custom code to connect to data sources and tools. According to an article from Medium, initial implementation costs for AI automation integration can require between $50,000 to more than $300,000, depending on the size of the business and complexity of implementation.

What’s more, every update could break the connection, causing time-intensive and expensive rework. In fact, the same article calls out that maintenance, updates, and system monitoring can represent 15 to 25% of initial implementation costs annually, impacting long-term ROI calculations.

This type of time and expense can lock you in to a vendor for the long term, making it difficult to easily adapt and innovate down the road.

Now, LoanPro’s MCP gateway is enabling financial organizations to more quickly and safely modernize their lending and credit servicing models with built-in compliance guardrails and full auditability.

This will enable a myriad of AI use cases for modern lenders — such as cutting resolution time for loan servicing teams by answering customer questions more efficiently based on information from verified API calls. This is just one example of loan servicing automation that AI can help power.

LoanPro’s MCP also ensures AI is not just implemented efficiently, but compliantly. Within the lending space, compliance is non-negotiable. Companies need to trust that their AI agents and models are following the laws set forth by governing bodies. While AI tools don’t inherently have compliance and regulation built into them, LoanPro’s MCP does. By wrapping AI interactions in LoanPro’s regulatory controls, structured data, and modern infrastructure, LoanPro MCP makes AI-powered servicing and collections both practical and defensible.

Want to see how you can safely connect AI to your servicing data? Download the LoanPro MCP one-pager to learn more.

What Model Context Protocol actually is

Model Context Protocol (MCP) is an open standard that connects AI models to data sources through a universal interface. Again, like USB-C plugs for devices, MCP lets any AI model access any data system without custom integration. For lenders, this means deploying AI that can read loan data, take actions, and maintain audit trails — all while staying secure and compliant.

How MCP works without the technical jargon

The MCP architecture has three key participants: the host, client, and server.

- The MCP host is the AI application that coordinates and manages one or many MCP clients.

- The MCP client is a component that maintains a connection to an MCP server and obtains context for the MCP host to use.

- And, the MCP server is a program that provides context to MCP clients.

In simple terms, MCP clients are managed by an MCP host which coordinates the connection to any MCP server.

Why this matters more than just another API

The core difference between an MCP vs API (i.e., application programming interface) is that an MCP is specifically designed for AI context, not just data exchange.

APIs are the foundation of modern infrastructures, serving as a messenger between two systems to facilitate the exchange of data. APIs are the endpoints to access that data while MCP goes beyond data exchange and gives you the AI tools to use that data safely and efficiently.

Three problems MCP solves that custom integration can't

Without MCPs, lenders are faced with three core problems that can’t be easily solved by custom AI integrations:

- Costly code rewrites to switch AI models

- No built-in controls for compliance and audits

- Lack of control and visibility over your data

Switch AI models without rewriting your entire stack

Custom integrations with hardcoded connections lock you into specific AI models (OpenAI, Anthropic) or tools (Salesforce, Slack), making it difficult to switch and creating silos. MCP provides a universal language that lets lenders swap models or platforms easily. If one tool or model stops working or becomes too expensive, it’s easy to switch without the need to rebuild or do additional custom integration work. This reduces the likelihood of vendor lock-in and fosters a more open ecosystem.

Every AI action gets an audit trail regulators can read

MCP gives financial organizations the ability to leverage AI while keeping every action compliant and explainable. It’s the first step toward human-AI servicing and the foundation for the future of agentic servicing.

This is a true differentiator among highly regulated industries like financial services and lending. Now, when regulatory bodies like the U.S. Consumer Financial Protection Bureau (CFPB) asks for information about why an AI model made a decision the way it did, you’ve got a clear audit trail to ensure compliance and reporting.

In addition, LoanPro’s MCP enables you to:

- Test and enforce compliance guardrails programmatically before any servicing or collections action occurs.

- Access a full audit trail for all human and AI agent actions, enabling explainability for regulators and internal teams.

Your loan data stays in your infrastructure

MCP lets AI applications interact with external data sources and tools without the data ever having to leave your organization's secure environment. Unlike methods where data might need to be copied or sent to external AI model providers for processing, MCP ensures the AI interacts with the data in place, ensuring data never leaves your control.

How lenders are using MCP in real operations

Today, lenders can leverage MCP to integrate AI agents securely and compliantly with their existing systems, automate and streamline various critical operations, particularly in consumer lending and banking services. Here’s a few more specific examples:

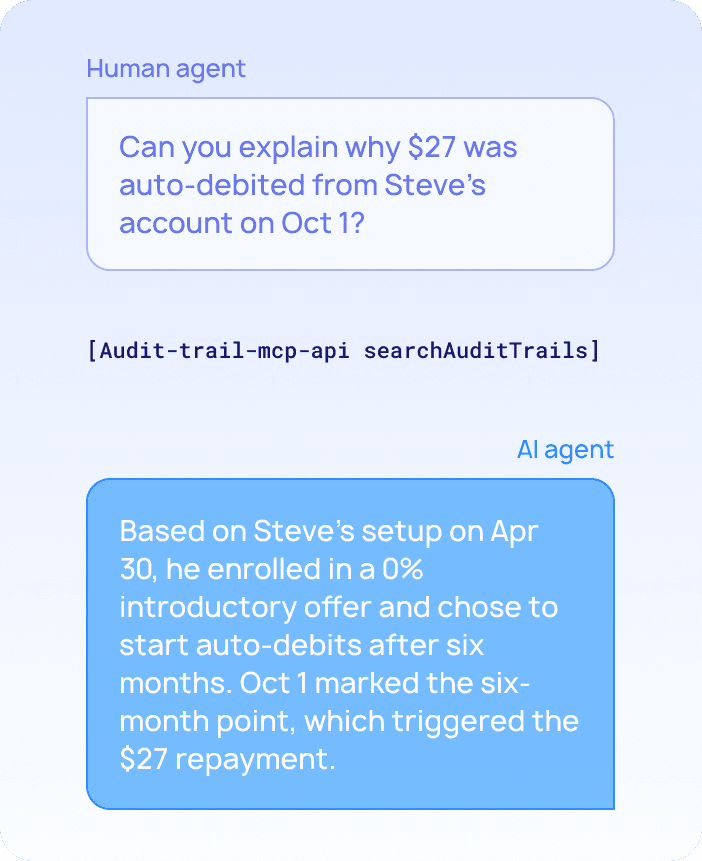

Servicing teams get instant answers instead of system hopping

Without AI, a simple question from a borrower — such as “Why was $27 auto-debited from my account? — could lead a human agent down a proverbial rabbit hole of systems and audit logs to find the answer.

WIth AI, the servicing team can simply type the question into MCP, which will translate the question into verified API calls to pull audit logs, repayment schedules, and payment rules to provide a clear answer. As a result, borrowers get answers faster and agents can dramatically reduce resolution time from minutes to seconds.

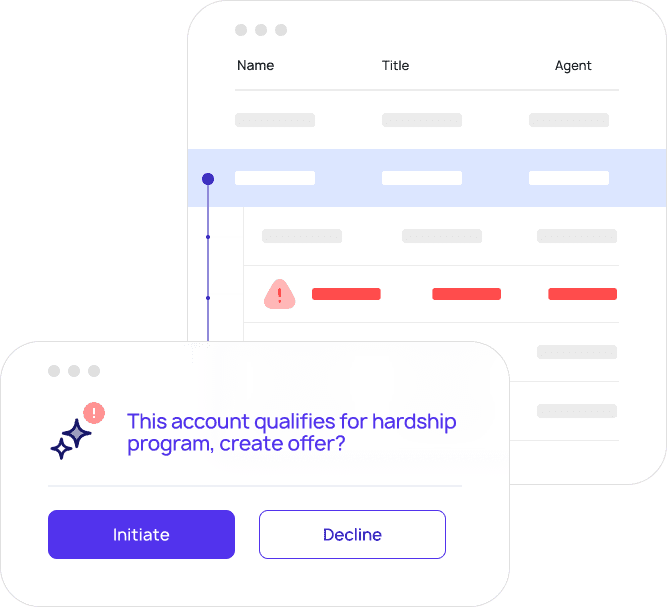

Collections spots financial hardship before borrowers stop paying

AI can also help lenders support borrowers on their financial journeys by spotting opportunities to proactively help. In this example, AI analyzes account data, flags financial stress signals, and automatically recommends compliant hardship options for an agent to review.

Once an agent reviews and approves, options can be quickly and easily deployed. And, by using AI to spot these opportunities to help, lenders can reduce manual queue reviews and improve the borrower experience, reducing delinquency rates while staying compliant.

Why LoanPro built the only MCP for lending

LoanPro built the first-of-its-kind, model-agnostic gateway built to MCP standards to make it easier for our clients and partners to innovate for modern lending without costly custom integrations or compliance nightmares.

MCP is the future of modern lending, creating a universal connector to enable models and agents to access and leverage data across multiple tools and systems.

LoanPro’s MCP acts as a secure AI integration protocol between any AI model and LoanPro’s core platform to enable financial providers to:

- Connect their own AI models safely to LoanPro’s platform.

- Test and enforce compliance guardrails programmatically.

- Access a full audit trail for all human and AI agent actions.

- Accelerate innovation by enabling AI agents to “talk to a loan”, surfacing answers in seconds.

- Lay the foundation for AI agents to independently execute end-to-end servicing actions aligned with client SOPs, program requirements, and compliance guardrails.

Ready to deploy AI without the integration nightmare?

If you’re ready to see what MCP can do for AI in lending, supporting your servicing teams, collections strategies, and more, check out our LoanPro MCP one-pager.