Why lenders are choosing LoanPro as a Fiserv alternative

Many articles and blogs tackle the broad topic of Fiserv alternatives. But, what they don’t delve into is why people are searching for an alternative to Fiserv. The search for a 'Fiserv alternative' is often a symptom of a deeper problem: being constrained by legacy technology.

Searching for a Fiserv competitor to be your new vendor is often not the answer. Instead, financial institutions, fintechs, and credit providers need a new approach that addresses the core challenges behind monolithic, outdated systems. In this post, we’ll outline:

- The real reason you're searching for a Fiserv alternative

- Common pains of legacy core systems: Slow innovation and operational drag

- Understanding the Fiserv alternative landscape

- The real choice: Modern platform vs. legacy system

- What defines a modern credit platform?

- How LoanPro solves the core problems of Fiserv

- Choosing the right path for your institution's future

The real reason you're searching for a Fiserv alternative

Fiserv is one of the leading core banking providers in the market, serving 42 percent of banks and 31 percent of credit unions, as well as fintechs and merchants, with a Fiserv core platform such as Premier, Precision, DNA, or Cleartouch.

Despite this broad market adoption, many financial providers, particularly regional banks and credit unions, are looking for alternatives that can help them lower costs, increase flexibility, offer better customer support, more easily integrate with newer technology, and offer more product functionality in a modern credit landscape.

This isn’t just about finding a new vendor that can replace Fiserv and meet these needs. As customers demand faster, more seamless financial services, the operational drag of legacy core systems can significantly impact a company’s bottomline.

Common pains of legacy core systems: Slow innovation and operational drag

Some of the most common pain points that financial providers face with legacy core systems include:

Sluggish processes: Manual, batch-based workflows slow down everything in the credit lifecycle from applications to servicing. In addition, legacy systems typically require more manual processes and experience more disconnected workflows.

Disconnected data silos: Most legacy solutions have data dispersed across multiple systems, preventing a single source of truth for lenders that hinders reporting and decision-making using actionable insights.

Inflexible products: The rigid architecture of legacy core banking platforms makes it difficult and time-consuming to launch innovative credit products (e.g., specialized cards, LOCs, BNPL).

Heightened compliance risks: Legacy systems often lack the built-in features and automation needed to ensure compliance as the regulatory landscape evolves without significant manual work.

All of these challenges can create operational bottlenecks and slow down the pace of innovation for banks, credit unions, fintechs, and other lenders looking to compete in today’s fast-paced credit landscape. So what are the alternatives?

Understanding the Fiserv alternative landscape

For those searching how to replace Fiserv, the options come down to turning to one of Fiserv’s competitors, exploring niche point solutions, or augmenting your legacy banking system with a composable banking architecture.

Category 1: Other legacy monoliths

While several competitors to Fiserv exist, including FIS and Jack Henry, these options are typically more of the same.

Fiserv vs. FIS: Both Fiserv and FIS offer core banking, payment processing, and financial technology solutions for banks, credit unions, and merchants. Fiserv is typically cited as strong with community banks and merchants while many larger banks turn to FIS.

Fiserv vs. Jack Henry: Jack Henry has a strong focus on small and mid-sized banks — and continues to gain market share with credit unions across all asset sizes, especially larger ones.

While replacing Fiserv with another legacy monolithic core — a single, unified platform or system for managing these operations — may feel like a step in the right direction, these choices are often a step to the side instead of forward.

Category 2: Niche point solutions

Niche point solutions, such as Adyen (an all-in-one payment platform to accept payment, protect revenue, and control your finances), can be useful tools in providing the capabilities a financial provider needs. However, these tools will only solve for specific use cases and can’t replace a core banking system that offers a unified platform.

The real choice: Modern platform vs. legacy system

So, instead of looking for how to replace Fiserv, smart financial providers will instead evaluate a modern platform approach against legacy systems. A modern credit platform isn’t a rip and replace strategy that swaps one core banking provider with another. This may be the best Fiserv alternative for many lenders and other financial providers.

What defines a modern credit platform?

Using a modern, API-first credit platform, banks and credit unions can more easily layer on top of existing infrastructure to act as a "system of engagement" — enabling new capabilities without disrupting the core's primary functions. This creates a more sustainable modern credit platform that evolves with the business without requiring a costly core banking transformation every decade.

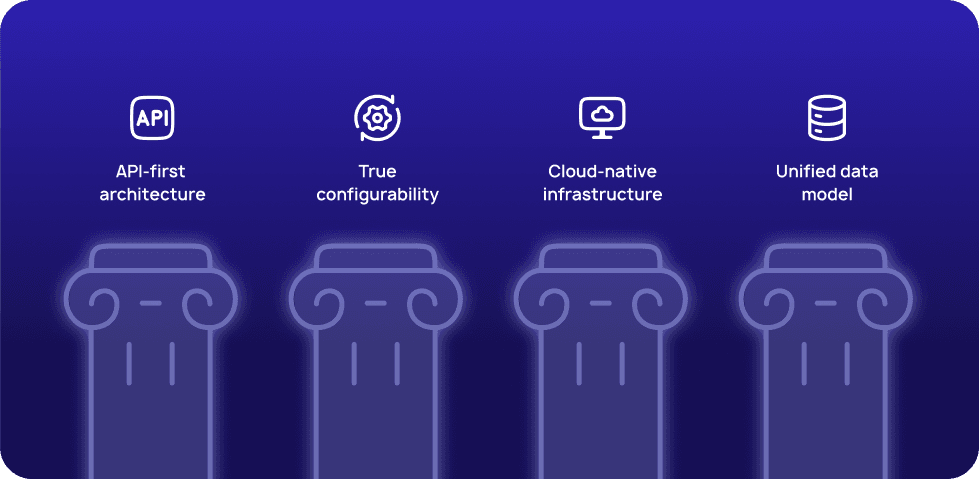

Key pillars of a modern credit platform include:

1. API-first architecture: A configurable, API-first banking platform enables you to configure it to fit your needs and enable real-time data sharing between systems.

2. True configurability: Configuration, rather than customization, uses the system's built-in tools to make adjustments so that you can rapidly design, launch, and service new programs. On the flip side, customization requires time and money to write new code or modify core code.

3. Cloud-native infrastructure: A cloud-native architecture empowers you to scale seamlessly, bringing new products to market faster, improving reliability, and enabling rapid innovation.

4. Unified data model: A modern credit platform will work as a centralized, secure, single source of truth for your operations to give you unprecedented visibility and control over how you manage your data.

How LoanPro solves the core problems of Fiserv

LoanPro is the only composable, API-first lending and credit platform proven to unlock innovation without sacrificing scale, speed, or efficiency. If you’re evaluating Fiserv vs. LoanPro, here are the key differences to consider:

From slow change requests to rapid product launches

LoanPro enables credit providers and lenders to configure and launch new credit programs in weeks, instead of years. Case in point: Kawasaki turned to LoanPro to launch its new retail finance product in just 48 days, a fraction of the industry average of more than 6 months. And, Best Egg launched three hardship programs within 60 days at the start of the COVID-19 pandemic — an "absolutely unheard of" outcome, according to Best Egg’s COO Alex Rhodes.

From a closed system to an open, API-first ecosystem

LoanPro’s API-first approach allows financial providers to build a best-in-class tech stack without being locked into a single vendor's ecosystem. Our composable banking architecture uses a modular approach that leverages reusable, interchangeable components to build and integrate banking products and services.

From inflexible processes to granular configuration

With a focus on configuration, LoanPro makes it easy for financial providers to control the full logic, rules, and defaults for any credit product without costly, back-end coding. For example, LoanPro’s Programs feature lets you define how your line of credit and credit card products behave — from how interest is calculated to how fees are charged, statements are generated, and payments are handled across linked accounts. Each program acts as a blueprint. Once it’s set, any account in that program will follow the logic, rules, and defaults you’ve configured.

Choosing the right path for your institution's future

Every lender has a choice in how it modernizes its systems. And, for us, the choice is clear. Instead of being constrained by legacy technology or trading one monolith platform for another, it’s time to embrace a modern platform built for growth and innovation.

That’s exactly how UBIZ, a non-profit Community Development Financial Institution (CDFI) dedicated to serving minority and disadvantaged businesses, overcame frequent system breakdowns and long turnaround times to resolve issues.

“Working with LoanPro and Rapid Finance reframed our perspective on business operations – we’re not focused on what we can’t do but rather what’s possible.” —Alisa Bray, Director of Operations, Portfolio Management & Programs

UBIZ tapped LoanPro and Rapid Finance to modernize its lending tech stack. By integrating these two technology solutions, UBIZ transformed its operations, positioning itself to scale and diversify its loan offerings in the near future. Now, the only question is what else is possible.

LoanPro’s modern credit platform has enabled more than 600 clients to launch over 2,000 programs across every aspect of their operation — driving faster innovation and clear business value. If you’re ready to swap your legacy banking systems with a modern credit platform that can unlock new innovation, reach out to us today.