Top AI in lending trends in 2025: What will actually move the needle (and how to implement safely)

Right now, somewhere in the U.S., a lender is deploying an AI underwriting assistant. The promise is compelling: faster decisions, lower costs, expanded approval rates. But here's what most implementations are missing—clear audit trails, explainable adverse actions, and real-time visibility into what the model is actually doing.

This isn't a hypothetical risk; it's a direct consequence of one of today's most powerful fintech trends: the rapid rollout of AI in financial services. This expansion is drawing intense scrutiny, with Massachusetts Attorney General Andrea Campbell recently settling with Earnest Operations over AI underwriting models that allegedly produced discriminatory outcomes. The CFPB has raised concerns about chatbots that fail to recognize when customers invoke legal rights, and state regulators are circling, each preparing their own—often contradictory—AI guidance.

The pattern is clear: AI is rolling out across lending faster than governance frameworks can keep up. The question isn't whether to adopt AI. It's whether you can deploy it in a way that doesn't create compliance blind spots.

In this guide, we'll examine seven trends reshaping lending in 2025—what's working in production, where implementations are falling short, and how to adopt AI with the visibility and compliance guardrails that regulators (and your risk committee) will demand.

7 AI trends shaping the lending landscape in 2025

1) Origination and AI underwriting: Faster, fairer, and more transparent

For decades, underwriting has relied on a narrow set of inputs: bureau scores, employment verification, debt-to-income ratios. These signals might be correct, but they're often incomplete. Thin-file applicants get shut out. Gig workers with strong cashflow but irregular income patterns get declined. And manual review processes create friction that drives borrowers to faster competitors.

AI is changing this, but not in the way most headlines suggest. The real shift isn't "AI replaces underwriters." It's that lenders can now layer cashflow data, transaction patterns, and behavioral signals on top of bureau scores to build a more complete picture of creditworthiness—while maintaining the explainability that ECOA and FCRA require.

Through integrations with cash flow analysis providers like Plaid, Prism Data, and Nova Credit, lenders can analyze verified income stability, expense patterns, and liquidity in real time. Leading credit bureaus, like Experian, Equifax, and TransUnion, enrich traditional bureau data with alternative datasets. The key is that every data point feeds into a decision framework that can produce specific adverse action reasons when needed, not vague "the algorithm said no" explanations.

Some lenders are piloting underwriting copilots that summarize application files and draft credit offers. These tools don't make the final call; they give underwriters a structured first pass to review. The benefit is both speed and consistency, with AI-assisted workflows helping to catch blind spots and enforce the creditor’s policies.

But here's where most implementations stumble: speed without transparency is a liability. Every decline must include a clear, specific reason. Every model input must be documented. Every decision must be auditable. Regulators aren't asking whether you're using AI, they're asking whether you can explain what it did and why.

That's why compliance can't be bolted on after deployment. It has to be built into the architecture from the start: logged decisions, reason-code generation, and audit trails that show exactly how each data point influenced the outcome.

2) Risk and probability-to-pay: Forecasting with foresight

Traditional collections operate on lagging indicators. By the time a borrower missed two payments, it’s often too late to intervene effectively. Capital is locked up, recovery costs spike, and borrowers who might have responded to early outreach have already spiraled into default.

But machine learning models can incorporate earlier indicators, catching delinquency before it happens. Probability-to-pay (PTP) models from AI-powered risk modeling firms like Carrington Labs and Predictive Analytics Group can spot early warning signs—fluctuating cash balances, irregular income streams, shifts in spending behavior—that traditional scorecards miss. Servicing data platforms like Equabli layer in servicing data to forecast repayment likelihood and dynamically adjust collection strategies.

Some lenders are piloting real-time stress testing tied to macroeconomic indicators. Imagine knowing how your portfolio would perform if unemployment ticks up or inflation spikes—before it happens. That kind of foresight enables better capital allocation and smarter loss provisioning.

But here's the catch: foresight only works if it's actually predictive. A PTP model that flags the wrong borrowers creates two problems. First, you waste resources on unnecessary outreach. Second, you erode trust in the model, making your team less likely to act on future predictions.

That's why challenger models, backtesting, and bias monitoring aren't optional. Every PTP forecast needs to be explainable and auditable. If a regulator asks why you prioritized one borrower for hardship outreach over another, "the model said so" isn't good enough. You need to show which inputs drove the prediction and demonstrate that the model treats similar borrowers consistently.

The outcomes speak for themselves when done right. Lenders using AI-driven repayment forecasting have seen meaningful reductions in defaults, using AI to surface the right borrower at the right time with the right intervention. The question is whether your implementation can explain how it got there.

3) Fraud and identity protection: Staying ahead of the shape-shifters

Fraud doesn't look like it used to. Forget someone walking into a branch with a fake ID, today's threats include deepfake voice scams, synthetic identities stitched together from real data, and bots sophisticated enough to pass traditional verification checks.

A single fraud case is an operational nuisance, but with scammers scaling up their own operations through AI tools, the cumulative risk becomes existential. Every dollar lost to fraud hits the bottom line directly. And every false positive that flags a legitimate borrower erodes trust and drives them to competitors.

Fraud and identity platforms like Sardine use behavioral biometrics, device intelligence, and anomaly detection to spot fraud patterns invisible to human reviewers. Instead of flagging every out-of-pattern transaction, these systems distinguish between a legitimate borrower applying from a new device and a fraudster attempting to game the system.

The result? Fewer false positives, faster onboarding, and more confidence in approvals.

At the infrastructure level, this mirrors a broader, crucial trend in AI in banking, where payment networks like Visa and Mastercard are embedding AI into their rails to detect fraud across billions of transactions in real time. This scale matters because fraud stretches past the edges of any one lender's portfolio, spreading across the entire ecosystem.

But here's where visibility becomes critical again. AI fraud models can drift. Attack patterns evolve. What worked six months ago may miss today's threats. Without continuous monitoring, you're flying blind.

Fraud detection partners can be integrated directly into origination and servicing workflows, running identity checks, device scoring, and anomaly alerts in the background. But every flagged application needs to be paired with an adverse action explanation if it results in a denial. Otherwise, you're trading one risk (fraud) for another (fair lending violations).

The lenders winning this fight are deploying AI with continuous testing for drift, explainability, and bias. Because the fastest way to lose trust in a fraud model is to let it operate as a black box until it makes a mistake you can't explain.

4) Servicing and AI agents: The gap between hype and operational reality

AI agents are everywhere in the servicing conversation right now. The pitch is compelling: reduce call center costs, handle routine inquiries instantly, scale support without scaling headcount. And in controlled demos, these tools look impressive.

But production is messier than the demo. The CFPB has already warned that chatbots can provide inaccurate information, fail to recognize when customers invoke legal rights, and trap borrowers in unhelpful loops. Even if federal enforcement slows under new leadership, state regulators are preparing their own chatbot regulations, meaning your AI servicing approach will need to change across state lines.

AI agents are undeniably useful, but most implementations prioritize speed over accuracy and cost savings over compliance. An AI agent that can't recognize a FDCPA violation in real time (or worse, generates the violation on its own) is a liability.

So what does responsible agentic AI look like in servicing?

- First, context matters. Retrieval-augmented generation (RAG) allows AI systems to pull real-time borrower data (e.g., payment history, account status, previous interactions) so responses are grounded in tangible reality. Tools from providers like Yellow.AI and Kato can help human agents draft responses or escalate complex cases with full context already summarized.

- Second, guardrails are non-negotiable. AI agents need clear boundaries on what they can and cannot do. They need to recognize when a borrower is invoking legal rights and escalate immediately. And every interaction needs to be logged for audit purposes—not summarized or paraphrased, but captured verbatim.

- Third, human oversight remains essential. Early pilots show promise: AI copilots drafting hardship plans or loan memos can cut handling times while improving consistency. But the human agent still owns the final decision. The AI surfaces options; the human evaluates context and makes the call.

The vision of fully autonomous servicing agents handling complex borrower situations? That's still years away. What's achievable today is AI-assisted servicing—tools that make human agents more effective by handling basic cases themselves, assisting human agents through complex cases, and all the while maintaining the visibility and auditability that compliance demands.

Successfully implementing your servicing AI tools is less about sheer speed than it is intentionality. The lenders who succeed here will be the ones who deploy AI with enough visibility to know when the agent got something wrong, and enough control to fix it before it becomes an issue.

5) Personalization through hybrid decisioning: Tailoring credit without losing control

For decades, most credit and lending products have been one-size-fits-all: fixed schedules, generic repayment terms, standardized hardship programs (if the product had hardship programs in the first place). But life, of course, doesn't fit neatly into a spreadsheet. A small business might have seasonal cashflows. A gig worker might see income swing wildly month to month. Traditional systems struggle to adapt to these nuances, leaving borrowers underserved and creditors exposed to unnecessary defaults.

AI is making personalization practical—but only if you can maintain compliance while doing it.

In production today, machine learning models segment borrowers by behavioral and financial patterns and recommend repayment structures tuned to their actual ability-to-pay. AI-powered risk modeling firms build models that identify which borrowers are likely to need tailored plans, while cash flow analysis providers give the real-time cashflow signals that feed these insights.

Here's the nuance: personalization doesn't mean removing humans from the loop. Hybrid decisioning keeps underwriters and servicing teams in charge, while AI surfaces the right borrower at the right time with the right options.

The key is configurability with guardrails. Dynamic repayment workflows, flexible terms, hardship triggers, automated restructuring—all of these can be personalized. But every adjustment needs to comply with ECOA, TILA, and a dozen other requirements. Every tailored offer needs to be justifiable if questioned. And every decision needs an audit trail showing how the model reached its recommendation.

The outcomes show up in early pilots: higher repayment rates, reduced defaults, stronger borrower loyalty. Customers feel understood rather than penalized. Servicing staff spend less time firefighting and more time handling cases that truly require human judgment.

But this only works if the personalization engine is visible and auditable. A black-box model that offers different rates to similar borrowers without clear justification isn't “personalization”, it's a class action lawsuit.

6) Embedded AI and open finance: Infrastructure that enables (or constrains) innovation

Behind every credit decision is the infrastructure that connects data, routes payments, enforces compliance checks, and generates audit trails. Historically, that infrastructure has been fragmented, with credit bureaus on one side, payment processors on another, servicing systems stitched together in between.

This fragmentation creates friction. Data refreshes are slow. Borrower visibility is inconsistent. And innovation requires duct-taping new tools onto legacy stacks that weren't designed to integrate.

Open finance rails are dismantling this bottleneck. APIs from cash flow analysis providers allow lenders to ingest real-time transaction and cashflow data into underwriting and servicing models. Instead of evaluating a borrower once at origination, lenders can continuously update risk profiles as behavior changes. This enables dynamic credit lines, adaptive loan terms, and faster onboarding experiences.

AI makes these data streams actionable. Machine learning models trained on open finance data can detect early warning signs of delinquency, identify cross-sell opportunities, or optimize repayment schedules in ways static credit files never could.

But here's the governance question: greater data flows mean greater privacy and consent requirements. Lenders must clearly disclose what data is being used and why. Borrowers must retain the right to revoke access. And every AI model trained on this data needs to produce explainable outputs that satisfy FDCPA and FCRA requirements.

Beyond core data integration, early pilots are experimenting with agent-first borrower interfaces and tokenized lending models. Stablecoins and digital assets are being tested as loan collateral or payment instruments—a sign of how embedded AI and blockchain rails may converge in future credit ecosystems.

For now, these pilots remain exactly that: experiments. Regulators are watching stablecoin adoption closely, and the compliance scaffolding for tokenized lending is still being built. Lenders should proceed cautiously, building the governance frameworks that will allow innovation to scale safely.

7) Governance and explainability: Scaling AI without losing trust

The fastest way to kill trust in AI-driven lending is to make a decision you can't explain.

Borrowers are entitled to clear adverse action notices, and auditors (either governmental or internal) need to see a clear picture of what’s driving your decisions. Risk committees won't sign off on black-box models that can't stand up to scrutiny. And when something goes wrong—a model drifts, a bias emerges, a pattern of disparate impact appears—you need to know exactly what happened and why.

This is why governance cannot be a "nice-to-have" add-on. It's the foundation that makes everything else in this article possible.

Today, leading lenders are embedding challenger models to validate outputs, running scenario backtests to test how models perform under stress, and deploying bias monitoring to ensure fairness across borrower segments. NVIDIA's 2025 financial services report highlights pilots in real-time stress testing—tying risk forecasts directly to macroeconomic and behavioral data so lenders can understand how models will behave in a downturn, not just in steady-state conditions.

Governance is about organizational discipline:

- Model inventory: Can you produce a list of every AI model in production, who owns it, when it was last validated, and what decisions it influences?

- Reason-code integrity: When a model contributes to a decline, can you generate a specific, accurate adverse action notice that satisfies Reg B?

- Drift monitoring: Are you tracking model performance over time to catch degradation before it impacts borrowers?

- Audit readiness: If a regulator asks to see your documentation tomorrow, can you produce it?

These aren't hypothetical requirements. They're exactly what Massachusetts regulators extracted from Earnest in their settlement: written policies, risk assessments, bias testing, model inventories, documentation, oversight teams.

The good news is that none of this is revolutionary. It's just sound governance applied to a new technology. The challenge is that most AI tools on the market today weren't built with this level of visibility and control in mind. They were built to optimize for speed and performance—with governance bolted on later as an afterthought.

That's the architectural choice that separates AI implementations that scale safely from those that become compliance nightmares. Because you can't retrofit visibility into a black box. It has to be designed in from the start.

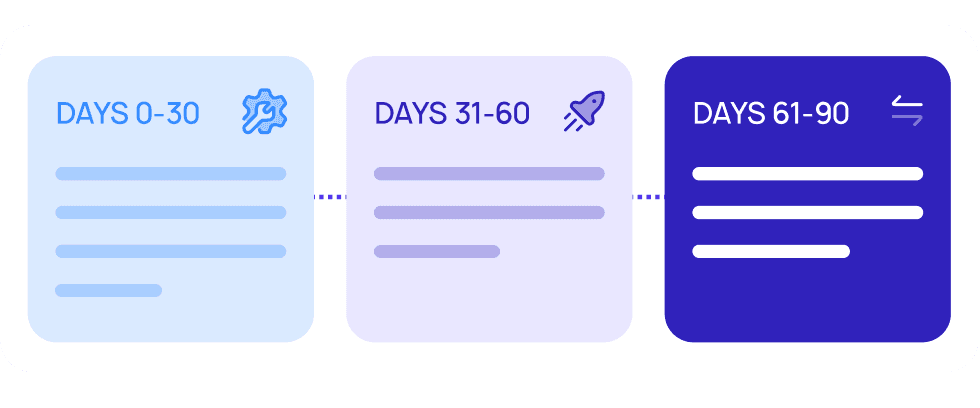

Your 90-day AI adoption plan: Building visibility and compliance into every phase

The seven trends we've explored show what's possible when AI is applied across the lending lifecycle. But knowing the trends isn't the same as putting them into practice. As we’ve spoken to creditors across the industry, one of the most common questions we hear is "Where do we even begin?"

The answer isn't to leap straight into autonomous AI agents or fully automated decisioning. It's to phase adoption deliberately, proving value quickly while building the compliance scaffolding you'll need for the long haul.

This phased approach keeps momentum high while ensuring that visibility, explainability, and auditability are baked into every layer. Here's what that looks like in practice:

Days 0–30: Build the data and visibility foundation

AI adoption begins with data quality and observability. Without clean, consolidated information, advanced models will only magnify existing gaps. And without visibility into how data flows through your systems, you won't know when something goes wrong until it's too late.

Start by auditing your current state:

- Where do data silos exist between origination, underwriting, servicing, and collections?

- Can you trace a decision back to the specific inputs that drove it?

- Do you have a complete inventory of where AI is already being used (even in small pilots)?

Launch low-risk automation pilots in areas like document parsing or credit scoring augmentation. These use cases provide quick wins—faster processing, reduced manual review—while establishing the governance patterns you'll need for more complex AI later.

The philosophical shift: Think of this phase as building the operational equivalent of "trust, but verify." You're not trusting the AI to be perfect. You're building systems that make its actions visible so humans can verify, correct, and improve outcomes over time.

Why this matters: Getting your data and observability foundation in place avoids the common pitfall of running advanced AI on fragmented, low-quality inputs with no way to diagnose issues when they arise. A clean, visible foundation is what allows you to scale safely.

Days 31–60: Deploy predictive risk models in shadow mode

Once the foundation is in place, move from reactive to predictive risk management. Introduce probability-to-pay (PTP) forecasting or early delinquency detection into servicing workflows—but run these models in shadow mode first.

Shadow mode means the model makes predictions, but you compare those predictions against actual outcomes without letting them drive production decisions yet. This proves ROI in a controlled environment while identifying where the model needs refinement.

During this phase:

- Track prediction accuracy: How often did the model correctly identify borrowers who would miss payments?

- Monitor for drift: Are predictions getting less accurate over time?

- Test for bias: Are similar borrowers being treated consistently, or are there unexplained disparities by protected class?

The philosophical shift: This is where you learn whether your AI actually knows what it claims to know. Shadow mode is your safety net—a way to validate that predictions are reliable before you act on them.

Why this matters: Predictive models can deliver significant value (lower defaults, better recovery rates), but only if they're accurate and explainable. This phase proves the model works before you commit to full deployment—and builds the trust you'll need from risk committees and auditors.

Days 61–90: Introduce AI-assisted workflows with human oversight

With predictive insights validated, turn your focus to borrower experience and operational efficiency—while maintaining strict human oversight.

Deploy AI copilots to handle structured, routine tasks: drafting loan memos, generating hardship summaries, suggesting repayment options based on cashflow data. These tools don't make final decisions—they surface options for human agents to review, accept, modify, or reject.

Simultaneously, establish governance frameworks:

- Maintain a model inventory documenting every AI tool in production

- Run fairness audits to ensure consistent treatment across borrower segments

- Ensure adverse-action explainability is baked into every decision workflow—not added as an afterthought

The philosophical shift: AI isn't replacing human judgment—it's augmenting it. The goal is to give agents better information faster, while preserving their ability to exercise discretion and ensuring every action remains auditable.

Why this matters: This is where lenders begin to see customer experience gains at scale—faster response times, more consistent outcomes, higher first-contact resolution—while embedding the compliance controls regulators demand. You're proving that AI can deliver efficiency without sacrificing accountability.

Beyond 90 days: Scale with confidence

After completing the first three phases, you're positioned to explore more advanced use cases: continuous borrower monitoring through open finance rails, agentic servicing for low-complexity interactions, and real-time stress testing tied to macroeconomic indicators.

But the foundation remains the same: visibility, explainability, and human oversight. Every new AI capability should be deployed with the same governance rigor you established in the first 90 days—audit trails, reason-code generation, bias monitoring, and challenger models.

The lenders who scale AI successfully aren't the ones who moved fastest. They're the ones who built systems where AI operates within visible, auditable guardrails—so when regulators come asking, the answer isn't "we trust the AI." It's "here's exactly what the AI did, why it did it, and how we verified the outcome was fair."

The road ahead: Where do we see AI reshaping lending?

The seven trends we've explored don't exist in isolation. Together, they point to a lending ecosystem where decisions are made with richer context, fraudsters are met with adaptive defenses, and servicing feels less like a queue and more like a conversation.

What's striking is how quickly some use cases are moving from pilot to production. Underwriting copilots, probability-to-pay forecasting, and fraud detection are already redefining daily workflows for forward-thinking credit provider.

But speed without visibility is reckless. The difference between AI implementations that scale safely and those that become compliance nightmares comes down to architecture: Was governance built in from the start, or bolted on later as an afterthought?

At LoanPro, we see our role as building the connective tissue that makes responsible AI adoption possible—platforms where compliance isn't a retrofit, but embedded into every decision by default. Where audit trails aren't optional add-ons, but fundamental to how the system operates. And where visibility into what AI is doing isn't a luxury, but a prerequisite for going live.

The compliance risk with AI is real, but it’s fundamentally no different to the risk of hiring a human and trusting them with your operations. The path forward is to implement AI with intentionality.

Want to learn more about how AI is reshaping the lending and credit industry? Last September, 300+ industry leaders gathered at the Bonneville Salt Flats in the middle of the desert to discuss this. Watch the On-Demand webinars and forums here, starring thought leaders including Alex Johnson and Jason Mikula.

FAQs

Q1. How is AI being used in lending?

AI is applied across the full lifecycle:

- AI-augmented credit scoring layers cashflow signals from open banking platforms onto traditional bureau data

- Automated document processing speeds origination by parsing files and auto-populating borrower data

- Machine learning risk models power probability-to-pay forecasting, delinquency prediction, and fraud detection

- AI servicing copilots assist agents with drafting responses, summarizing borrower situations, and suggesting resolution paths

The key distinction: tools that are actually production-ready maintain explainability and human oversight. "AI is live" doesn't mean much if it can't pass an audit.

Q2. How are mortgage lenders thinking about AI in 2025?

Mortgage lenders are focused on cutting underwriting cycle times, automating document verification, and enhancing credit models with alternative data. But they're also acutely aware of compliance risk—ECOA and FCRA requirements mean every decline needs a clear, specific adverse action reason. The lenders succeeding are the ones building AI with governance frameworks from day one, not retrofitting compliance later.

Q3. Is there bias risk in AI mortgage lending?

Yes. Regulators are laser-focused on ensuring AI models don't replicate historical discrimination. The Massachusetts AG settlement with Earnest is instructive: lenders must now maintain model inventories, conduct bias testing, run challenger models, and document oversight processes. Bias risk isn't theoretical—it's actively being enforced.

Q4. How is AI being used in commercial lending?

Commercial lenders are deploying AI in:

- Automated onboarding for SMB loan processing

- Risk monitoring using machine learning to flag delinquency and fraud signals early

- Collections optimization through probability-to-pay models that segment accounts by likelihood of cure

This is particularly valuable in SMB credit, where traditional underwriting often leaves gaps. AI can expand access while reducing risk—if implemented with proper guardrails.

Q5. How can AI improve loan management?

AI improves loan management by enabling:

- Proactive borrower communication through AI-assisted agents that surface the right message at the right time

- Fraud detection using behavioral biometrics and device intelligence to catch threats in real time

- Portfolio monitoring with machine learning models that forecast roll rates and charge-offs before they materialize

The result: lower cost-to-serve, higher recovery rates, and better borrower experience—assuming the AI operates with visibility and explainability intact.

Q6. How will AI impact banks and financial institutions?

AI is becoming foundational infrastructure in banking and lending. Institutions are modernizing origination, adopting fraud controls, and piloting servicing agents. But the biggest shift isn't technological—it's organizational. Lenders are learning to balance efficiency with governance: maintaining model inventories, monitoring for drift, conducting fairness audits, and producing documentation that satisfies regulators. The winners won't be the ones with the fanciest AI. They'll be the ones whose AI can pass an audit.