Loan Servicing Software Best Practices

Using loan servicing software can empower private lenders, credit unions, and other financial institutions to keep track of and collect debt more efficiently. However, these opportunities won’t come to fruition if you don’t know how to use the software correctly.

It doesn’t matter how much better or more powerful the loan servicing software may be. What matters is that you take the necessary precautions to test the software correctly and introduce it to your team before fully implementing it as part of your workflow.

In this post, we’ll discuss the best practices for using your loan servicing software so you can manage and collect debts more efficiently and generate revenue for your business.

#1: Take Time to Learn About the Software

The prospect of using a brand new loan management software solution that can help your staff save time and offer a better experience to customers is exciting. At the same time, you don’t want to rush into using the technology without fully understanding its scope.

If you don’t take time to develop your understanding, you might not know how to get the best out of the included features. You also run the risk of setting up workflows in a way that doesn’t best serve your end-users.

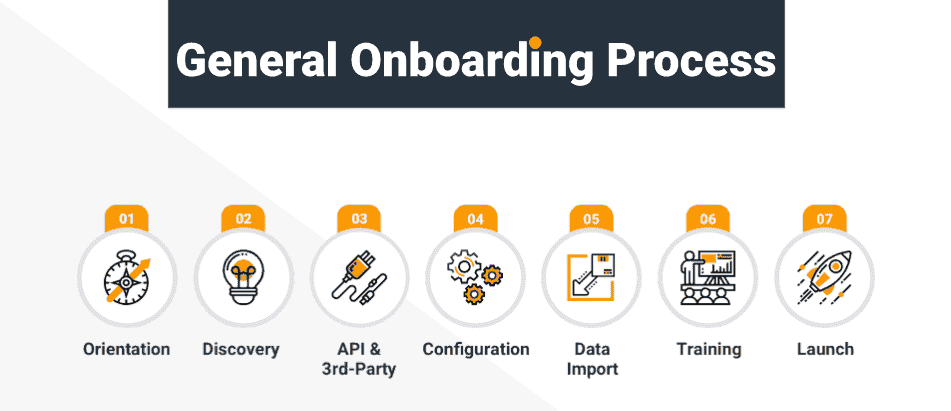

During the transition to the new software, expect changes in your internal lending process that could affect your entire organization. You won’t know what these changes are until you’ve tested out the software with an implementation team consisting of technical and subject matter experts.

The team’s goal is to learn everything about the software so they can seamlessly transfer your current system and database. This way, you get to identify potential issues and resolve them immediately before implementing the platform for all to use.

#2: Test First Before Implementation

While your team may already be familiar with using loan servicing software, expect users to raise concerns regarding the new software solution. There might be bugs or issues that need to be resolved. Furthermore, without first testing, your mistakes could quickly affect your database and records.

Once you put together your implementation team to help you determine how to migrate your system into the loan servicing software, start testing it out to ensure there won’t be any problems with functionality, security, integration, or scaling.

Also, take this opportunity to put the software through the wringer and see if it truly is the best loan management software out there.

With your implementation team and end users, take into account these considerations:

- Reliability — The software should always be available to process and store data accurately. If the software crashes and affects your data, there should be a recovery management process in place so you can recover your files with little to no impact on your customer data or business operations.

- Security — The platform should be secure enough to protect your sensitive data from hackers and malware. Your loan servicing software will store highly sensitive personal information, so it also must facilitate adherence to regulatory compliance.

- Usability — How easy to use and intuitive the software is should be a huge consideration. It will be used by members of your institutions looking for a platform that will get the job done for them faster and with less hassle.

#3: Automation

One of the business requirements of loan servicing software is that it should automate the most repetitive tasks. Finance companies use automation to save time, cut costs, and free up resources to complete more intensive tasks.

At its best, loan servicing software should guide your actions and help you make the most out of the time you devote to managing customer loans. But using the best software available won’t matter if you’re not there to make informed decisions and execute the necessary actions.

Below are tasks in your loan servicing system that you should consider automating:

- Regulatory compliance management — Determine which regulations are applicable in your loan system and translate them into decision rules using your system. Also, since the laws frequently change, monitor these changes and apply them in your workflow to reduce errors.

- Data management and record-keeping — Digitize your paperwork and have all documents and files in a secure and efficient cloud-based system. You can get documents signed by lenders and customers using digital signatures. If lenders are searching for files from the database, they can type in the name, and it’ll appear in a few seconds.

- Billing and payments — The use of automation for payment processing has become necessary due to overpayments and short pay caused by human errors. By developing an approval workflow process through automation, financial institutions can reduce inefficiencies and calculate the correct payment figures.

- Complicated process at risk for human error — Some lending processes are more complicated than others and could use a guiding hand to help accomplish. Processes such as Bankruptcy, SCRA, Fraud and more can be automated to ensure the user of the software follows a preset process to minimize the risk of error.

Ultimately the automation of a software is only as good as the rules and logic that dictate it. Ensure your rules are sound or enlist the help of your lending software expert to solidify your automations.

#4: Train Your Team

Once you are familiar with how the loan processing software works, you need to share your knowledge of the tool with lending professionals, private lenders, and others in the institution.

It may take time for everybody in the organization to get used to the new loan servicing software. The platform may possess better features than your legacy system, but navigating through the different functions may not be entirely intuitive.

In this case, provide your end users with training materials and resources on using the software as part of their workflow. You can get the implementation team to create a knowledge base for questions on using the software and performing tasks properly.

They can also run onboarding seminars for each team, so everyone has the opportunity to ask questions. The end goal should be to ensure everyone is on the same page when it comes to using your lending software.

When creating resources that people in the organization can use as references, keep in mind the following:

- Get your terminology right — Use the correct terms and naming conventions used by people in your financial institution. For instance, “loan” is not the same as “transition,” so you can’t interchange these terms across your documentation. This is why you need representatives from each department in your implementation team. They will help communicate the correct language to their respective teams when using the loan origination software.

- Establish requirements and priorities — Find out the data requirements for each department to successfully transition to the new software. You also must schedule the transition on time so everybody will be using the latest software at once. This process should be included as part of your documentation about the software.

- Promote accountability — The goal is for lenders to take charge of their projects and responsibilities using the new business software. It would help to set up a committee to ensure that all lending professionals have clarity on their specific tasks.

The faster you can integrate them with the loan servicing software, the faster they’ll be able to start taking advantage of all the benefits your technology provides.

#5: When in Doubt, Ask for Assistance

While you’re getting started using the software, expect to encounter problems that neither you nor the implementation team can solve. This is what happens when adapting to any new technology.

In this case, you need to contact your software provider’s customer support team for help.

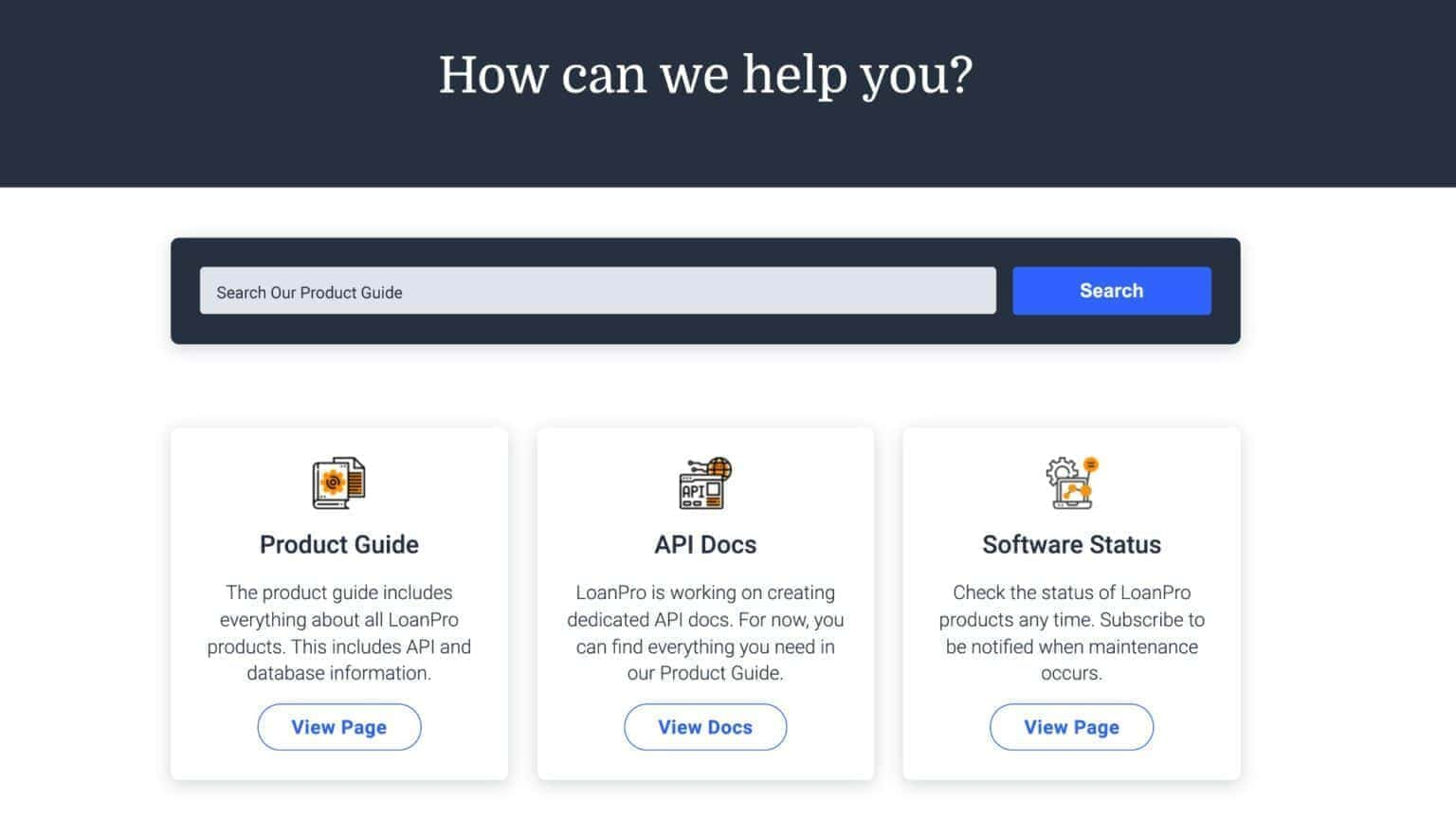

LoanPro provides you with all the resources you’ll need to solve any problems or issues you encounter using the tool.

You can check out the product guide from our support page or view the API Docs to learn how to use LoanPro’s developer-friendly API to integrate third-party apps into the software for easier data collection.

If you’re having issues with the software, the Software Status lets you know if the platform is undergoing maintenance. And, if none of the documentation is helpful to your issue, you can submit a ticket and customer support will get back to you shortly.

Using loan servicing software developed by a provider you can trust gives you the confidence that you’ll always have everything you need to optimize your loan platform and overcome challenges.

Conclusion

To get the most out of your loan servicing software, you and your entire organization must take the time to learn how its features can help you and your team work more efficiently.

It’s not about how good the software is—it’s about learning how to use it to your advantage.

Also, while automation is a big part of why you’re getting the software in the first place, only use it when it adds value to your processes. Keeping a human touch with loan servicing remains the best way to provide exceptional loan services to your clients.

When it comes to managing your technology with software best practices, LoanPro makes things easy. Its automation and API features let you build decision rules to simplify workflows and get more things done in less time.

Schedule a demo and experience the benefits of leading-edge loan servicing technology.