The Power of Automating Your Online Lending

Manual processes have been the norm across industries for decades. Finance and banking especially deal with extremely sensitive data, and, until recently, these industries relied heavily on manual processes to complete work accurately.

Today, automation has become a buzzword within finance and banking. It makes sense — after all, automation solves inefficiencies, increases productivity, and streamlines processes. But few understand exactly how it works and why every financial and banking company should take advantage of this inevitable innovation.

TL;DR – If you’re strapped for time, not a big reader, or always flip to the last page of a book before reading it – this section’s for you.

Behind every manual process is a person pushing the buttons. People are needed and necessary to be successful, but have been known to make mistakes from time to time. Automating certain manual tasks helps generate revenue, reduce risk, and create value.

Some of the added values of automation:

- Decreased loan turnaround time

- In-depth view of customer’s risk

- Accurate and updated data

- Improved customer communications

- Loan monitoring and easy audit trails

- All your data in one place

- Safeguards against compliance and regulations

LoanPro was built by lenders, for lenders – seeking to solve the same issues that you feel today. Book a call to see how LoanPro’s industry-leading automations have saved some of the biggest lenders in the game millions of dollars.

What Is Automated Lending?

The goal of consumer and business lenders is to generate profits, reduce risk, and create value through loaning funds. But the traditional loan approval process is time-consuming and can be inefficient.

The manual process that financial and banking organizations generally use to assess creditworthiness leads to longer loan approval times. This process includes necessary steps like:

- Running multiple, complex calculations

- Conducting a review of borrowing capacity

- Diving deep into borrowing history

- Calculating debt ratios

The time involved also impacts loan underwriting standards and costs.

Lending automation can solve these inefficiencies and more. An automated system makes going through a loan application a breeze. The software is designed to read, identify, and respond to loan applications, streamline underwriting, and manage the process for funding the loan.

And by integrating various technologies, including artificial intelligence and cloud technology, financial and banking companies can access real-time financial data to make informed decisions.

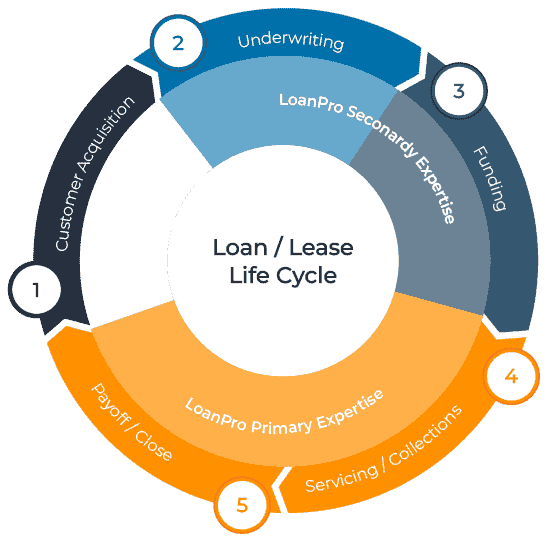

Digital lending helps with the entire loan process, including:

- Loan applications

- Credit decisioning

- Risk evaluation

- Origination

- Servicing

- Underwriting

- Reporting

- Collections

Essentially, harnessing automation through software helps organizations develop a sound business process to overcome delays, reduce costs, improve the overall quality of their loan portfolios, and elevate the customer experience.

This is incredibly important if you’re operating an online lending operation, where customers’ expectations about process speed, data security, and ease of use remain the foremost considerations.

7 Reasons Why You Should Automate Your Lending Process

Financial institutions face a specific set of challenges without automation, including compliance breaches, security issues, and delayed monitoring, and more. Lending automation can help improve business processes for financial institutions. Automation is your path forward if you aim to see cost savings, increase efficiency, and improve customer satisfaction.

Let’s look at the most significant benefits of automating your lending process, so you have a firm grasp of whether automation is the right choice for your business.

1. Significantly Decrease Loan Turnaround Time

Loan origination refers to the process that starts when a customer submits their loan application and ends when their funds are disbursed or the loan is rejected.

The traditional method of loan origination heavily relies on human resources. Lending staff or originators manually process and review each document. Without intelligent automation, this process increases labor costs, is time-consuming, and remains prone to human error. Eventually, these outcomes can result in frustrated customers.

Automating loan origination creates immense benefits for your business and your customers. You can process loan applications quickly and decrease turnaround time.

With the right technology, you can speed up the loan origination time by having a uniform process, relying on one location for your data, and streamlining your workflows.

Here are some of the specific ways that automation streamlines loan origination.

- You can have a configurable loan application that allows clients to fill out forms online. Depending on local and international regulations, these forms should be specific to each customer’s needs and reflect the right loan product.

- You can allow borrowers to digitally verify their bank accounts and details in their loan applications. This will enable your modern lending organization to get immediate bank statements and better view the applicant’s credit score.

- Automated lending software makes it easier for your staff to evaluate loan applications because it creates an accurate customer profile based on current data. This will allow loan managers to speed up application processing by engaging in informed decision-making. They will rely on accurate data gathered from multiple data sources and placed into one system.

- You can benefit from enhanced omnichannel communication. Loan staff can send automated emails with included electronic signatures to customers based on various triggers. For example, if an applicant’s loan has been approved, an automated email will inform the customer of any loan decisions they need to make.

2. Gain an In-Depth View of Your Customer’s Credit Risk

An essential function of any lending business is assessing a customer’s credit risk. Without accurate information regarding an applicant’s financial situation, it’s easy to make mistakes when disbursing or rejecting loans.

Proper credit analysis is an arduous task when done manually. Your credit analysts have to rely on data gathered from multiple sources, including the documents the customer submits into your systems.

This makes it difficult to accurately assess a borrower’s credit situation, leading to a delay in processing and the potential for human error. So how can automation help?

Automation will make it easier for your credit analysts to gain an in-depth view of each customer’s financial situation.

Software that will improve data visibility at every step of the loan process can help even more. Your credit analysts will be able to automatically see financial data in one platform so they can accurately assess risk.

Automation eliminates the need for manual data collection by going through different spreadsheets and documents to find out whether your customers should get that loan or not. Automating this aspect of credit risk assessment provides a single source for data and decision-making so you can run a smooth and accurate process that then speeds up other aspects of online lending.

3. Enhance Decision-Making with Accurate & Updated Data

Both the consumer and commercial loan approval processes rely heavily on having the correct data at hand so you can track each step and successfully close loans.

When your borrower data resides on several systems that don’t communicate with each other, you may lose valuable time tracking it down and piecing everything together.

Automation enables you to see the most relevant information about your customer. You can access accurate financial statements, credit checks, customer profiles, and more by having the documents stored in one place.

Your loan officers and other staff will have data at their fingertips so they can go through the loan process quickly and securely, with no need for pen and paper.

Make loan decisioning more efficient and accurate by deploying the right software. You can try out different options during the evaluation process. When you demo software, load a few applications in each lending solution to determine which one suits your organization best.

4. Improve Customer Communication & Satisfaction

When using traditional methods for loan processing, some banks delay lending decisions. This happens because of inefficiencies in the workflow, inaccurate data, and poor portfolio tracking.

Because your staff is drowned in manual work, they hardly have time to interact with customers or update them on their loan application status. And customers can become tired of filling out forms manually and waiting for updates.

All these inefficiencies result in delays, which can cause borrowers frustration and dissatisfaction. You can step up your customer relationship management by automating the lending process.

Automation can help you improve communication, resulting in more satisfied customers. With tailored online forms, your customers can quickly fill out their applications and submit relevant information to your systems, making things more convenient for them.

When you have a complete profile of your customers’ data, you can quickly make decisions on whether borrowers should be allowed to have an approved loan or not.

You can also automate communication, so your customers get emails or texts at the same time that the loan is disbursed.

5. Easy Loan Monitoring & Detailed Audit Trails

Part of the loan management process entails monitoring the loan progression, managing payments, and understanding internal audit trails.

After completing the loan application process, many financial institutions engage in the tedious process of getting information from various data sources and bringing them together manually to create a report.

By the time the report is done, the loan has progressed to a different stage, delaying monitoring. This also makes it impossible to capture real-time data.

Additionally, you want to understand the progress of ongoing loans by tracking who is working on them and what changes or updates they make. Doing this with paper documents is cumbersome.

You can better understand who is doing what by leveraging detailed audit trails with an automated solution. If something goes wrong in the CRM system, for example, you can go back and find the specific cause and tackle any issues swiftly.

6. Data Integrity & Governance in One Place

Most financial institutions have a set risk tolerance to guide loan officers and credit analysts. Establishing this risk tolerance requires careful analysis of available data. If done manually, it might be inaccurate or out of date. Instead, you can automate your portfolio risk management process and benefit from accurate portfolio reporting.

There’s no need to manually bring data together from multiple sources and estimate critical indicators with automation. You can use multiple technologies, including machine learning, to guide you through the process and generate an accurate picture of your portfolio in real-time.

7. Efficiently Tackle Regulatory Compliance Concerns

With the regulatory landscape becoming more complex and new laws coming into effect all the time, it’s challenging for a lending business to keep track of everything.

You have to spend valuable time assessing each borrower’s quality and keeping data compliant with all applicable laws. Compliance often uses up resources, leaving staff less time to work on revenue-generating tasks.

Automating through software is the best way to go to streamline compliance. Advanced lending software has built-in compliance requirements and automatically puts borrower data through quality checks. You also benefit from detailed reporting, which enables an audit trail.

All of this makes managing loans and serving customers far more effortless, which can help you grow your lending business.

Conclusion

Now that you know the benefits your business can gain from automating lending processes, it’s time to choose a software solution. You want lending software to empower your business with advanced automation and data visibility.

LoanPro helps you at every step of the lending process, and because it’s a lending core built by lenders, it solves your key challenges and enables you to adapt to automation quickly. As an API-based technology, LoanPro also enables you to integrate your data, making it possible for you to boost efficiency while staying compliant and secure.

Fill out the form below and see how LoanPro can help you take your lending business to the next level.