Financial Institutions

Drive operational efficiency while staying compliant in lending and credit.

Challenges for financial institutions today

Inflexible infrastructure

Rigid software makes even simple updates near impossible

Increased risk

Regulatory burdens increase and default rates rise

Multiple servicing platforms

Data and servicing are split between multiple servicing platforms

Negative consequences of challenges

Inability to innovate

A legacy infrastructure causes 12+ month lead times to launch new products

Diminishing margins

Net profit margins for financial institutions are down by 48% year-over-year

Operational inefficiencies

The inability to drive growth and consolidate servicing tasks using data creates operational inefficiencies

The value that 600+ financial organizations achieve through LoanPro’s modern lending and credit platform

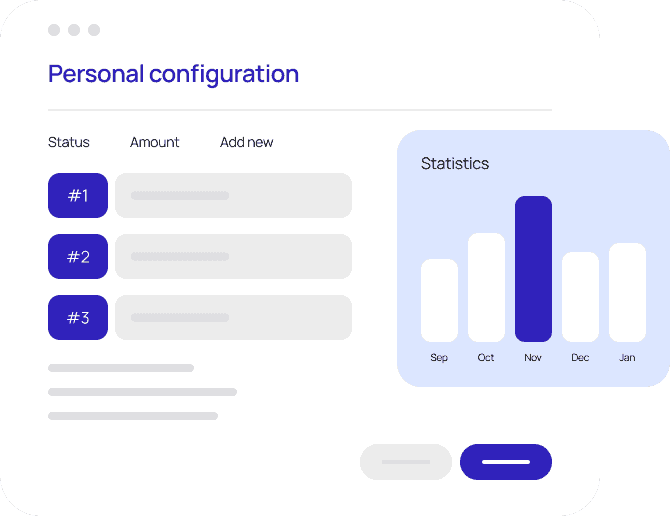

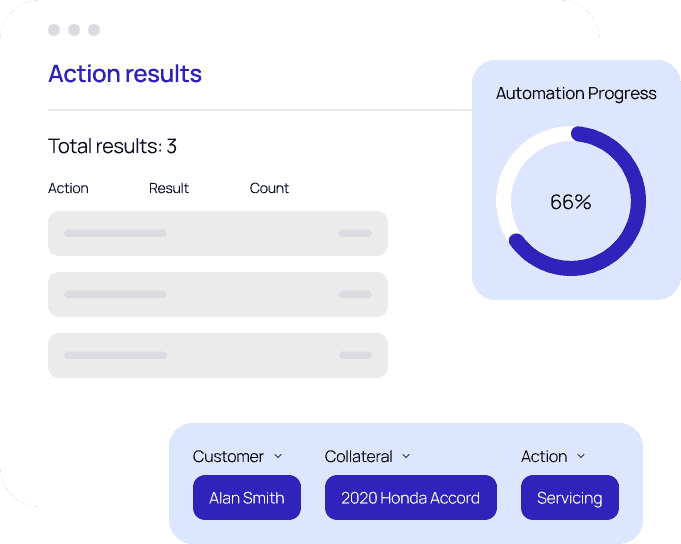

Increase operational efficiency with increased automation and configurability

- Embed your business logic into LoanPro’s Automation Engine to service lending and credit products in the background

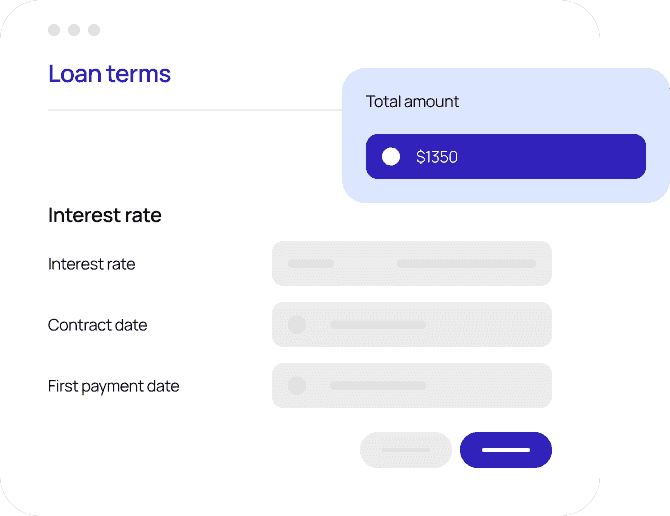

- Easily make changes to your lending and credit products without going through an order form process

Drive meaningful growth by launching differentiated credit products

- Launch any loan, line of credit, or credit card configuration imaginable

- Go to market with a new product without having to complete a change order

Retain existing customers and cultivate cross-sell opportunities that increase deposits

- Automation Engine solves problems before they arise

- Provide a delightful lending experience that drives borrower deposits to your institution

Reduce risk of defaults and regulatory fines

- Use hardship programs to keep struggling borrowers engaged instead of dropping off, thus decreasing your default rates and losses

- Compliance Safeguard keeps your operations aligned with ever-shifting regulations

How LoanPro solves the problem for financial institutions in a single platform

Modern Lending Core

Enable innovation through an API-first architecture to support unique loan programs.

Origination Suite

Increase your conversion rate from applicants to funded loans through highly configurable origination.

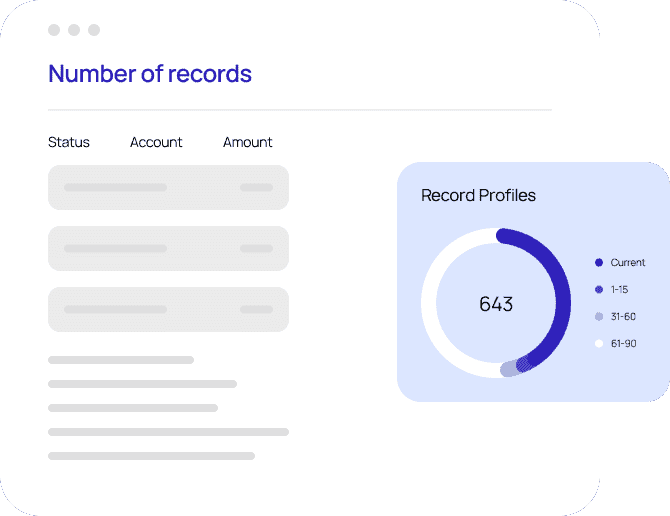

Servicing Suite

Streamline servicing tasks with automation and guided workflows.

Collections Suite

Communications, hardship programs, and more that build a highly performant loan portfolio.

Payments Suite

Automate the payment process through ACH, debit, and credit payments with PCI compliance.

Launch any class of loan, line of credit, or credit card on one, holistic platform

Installment loans

Create unique personal, small business, and commercial installment loans to differentiate in a crowded market

Credit card

Launch a truly differentiated credit card with innovative, patent-pending transaction-level credit

What our 600+ customers say about LoanPro

Why partner with LoanPro

The only lending platform at the intersection of innovation and scalability.

Innovate Quickly

- Configurable end-to-end platform

- Pre-configured templates for all classes of loans

- API-first to integrate with existing tech stack

Scalable Growth

- Launched over 2,000 credit programs

- 25M+ active loans on LoanPro

- Launch compliant loan modifications in days

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

Drive operational efficiency and innovate with LoanPro today

Talk with our team about improving operational efficiency for your lending and credit products.