Build custom loan solutions without limitations

Stop settling for preset loan structures. Our configurable lending software gives you the building blocks to create any credit or lending program imaginable.

A unified platform to launch credit programs

LoanPro’s composable architecture provides you with the flexibility to create and manage any type of credit program, with configurability in back-office, agent, and borrower experiences.

Origination Suite

Increase your conversion rate from applicants to funded loans with our configurable origination workflows that seamlessly integrate with all other loan life cycle activities.

Modern Lending Core

A reliable foundation that tracks all lifecycle events in our Real-Time Ledger while using Compliance Safeguard to keep you in line with updated regulations.

Payments Suite

Increase repayment rates by providing the ultimate payment flexibility and accept cash, check, ACH, and card payments.

Collections Suite

Streamline collections to reduce default rates with Agent Walkthroughs and automations built around your business logic.

Servicing Suite

Automate servicing tasks to match your custom business logic and increase operational efficiency by completing tasks in the background.

The tools necessary to launch fully configurable credit and lending programs

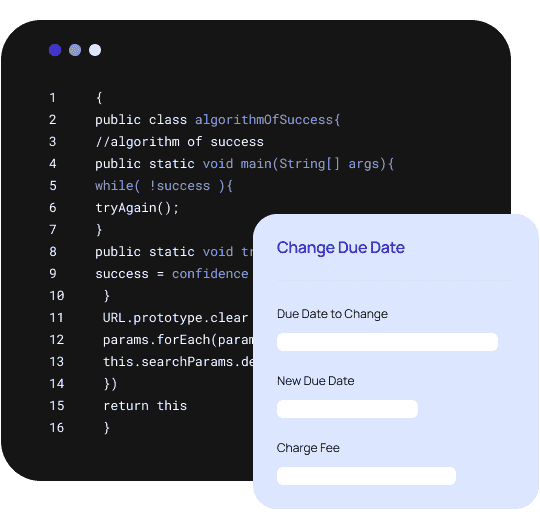

API-first, configurable platform

Trust that any financial product you launch is fully supported through robust configurability.

Adaptive calculations

Create highly-tailored contracts with a diverse set of calculation tools that matches your custom credit program.

Compliance Safeguard

Ensure you’re always in compliance with state-by-state regulations through pre-built guardrails in our Modern Lending Core.

Automation Engine

Put servicing on autopilot through rule-based automations that run in the background.

Flexible payment frequencies

Adapt payment schedules to meet borrowers’ needs using an extensive range of frequency type options.

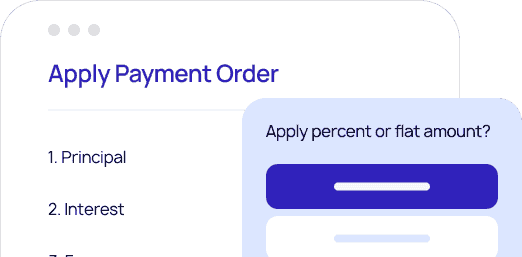

Customized payment application

Take charge in deciding the order of how a payment applies to principal, interest, fees, and more.

Customer Portal

Launch quickly by enabling your borrowers with self-service functionality through our configurable Customer Portal.

Comprehensive Loan Recasting

Easily make any necessary loan modifications to help past-due borrowers repay their loan, decreasing your default rates.

Launch truly differentiated credit programs

LoanPro’s API-first, configurable architecture allows our customers to launch targeted, differentiated credit programs. Here are a few examples.

Personal installment loan

Active military personal loan

Borrower experience:

- Lower interest rates on geofenced spending: Groceries and gas within a five mile radius of home incur a reduced 3% interest rate during deployment.

- On base promotions: A reduced 7% interest rate for Commissary and BX purchases.

- Build savings: Automatically put excess funds towards savings when members pay a large, monthly payment.

Back-office experience:

- Flip to installment: Convert large purchases into pay-in-four installment loans with the click of a button, reducing carrying costs for you and the borrower.

- Smart fields: Create logic-based fields that automatically verify military status when an agent inputs specific information.

- Payment programs: Drive repayment by offering qualifying customers due date changes, payment plans, and hardship programs.

Business installment loan

Merchant cash advance installment loan

Borrower experience:

- Automated communication: Keep merchants in the loop on payoff progress and inform them of options ahead of time.

- Comprehensive Loan Recasting: Should the need arise, easily modify live loans with full visibility into the Audit Trail.

- Fast funding: Get funds in merchants’ hands fast by pushing to a bank card or account immediately.

Back-office experience:

- Customizable repayment schedules: Create repayment schedules that align with merchants’ needs and your risk profile.

- Easy payment waterfalls: Simplify the profit-principal split by designing allocations upfront.

- Split loan repayments: Streamline repayment by collecting directly, or through split withholdings.

Create business value

with LoanPro’s configurable credit and lending platform

Increase operational efficiency

Automate servicing in the background to eliminate manual tasks and accomplish more with fewer resources.

Increase customer retention & loyalty

Delight your customers by providing unique, differentiated loan and credit products that are truly one-of-a-kind.

Drive growth

Capture segments of the market by tailoring lending and credit products to their needs.

Reduce risk

Establish your lending and credit portfolios on a platform built to scale while ensuring compliance with all necessary regulations.

Keep ahead of the game with a lending and credit platform that does more

API-first

- Configurable, end-to-end platform

- Compatible with your favorite partners and tools

Compliance

- Keep on top of compliance requirements, including CARD Act and SCRA

- Vetted solutions ensure your road to compliance comes with guardrails

Configurability

- Support any class of credit program, from B2B loans to consumer cards

- Ensure that your potential for growth is limited only by your imagination, not your software

Scalability

- Scale your business without growing pains

- Support millions of accounts from one, unified system

Related lending and credit programs that drive growth

Installment loans

Create unique personal installment loans to differentiate in a crowded market.

Credit card

Launch a consumer credit card that is attractive beyond merely a rewards program.

Answers to your questions about LoanPro’s modern lending and credit platform

Can I really create any custom credit program?

Yes. LoanPro’s composable architecture lets you create tailored programs that address borrowers’ needs and stay ahead in the market.

Is LoanPro capable of servicing any custom credit program?

Yes. Loans, leases, lines of credit, cards — any unique program you create can be fully supported by our API-first platform.

How fast can I go to market with a new program?

Among our 600+ lenders, we’ve seen companies create and deploy a new program within 3 weeks. However, the average time to go live is three months.

Can I issue credit cards and installment loans?

Yes. Issue and service both lines of credit and installment loans within LoanPro. Link the accounts to each other and to the same borrowers to drive growth and increased loyalty among your existing customers.

Launch differentiated lending and credit products today.

Talk with our team about how to accelerate growth with your lending portfolio.