Drive operational efficiency with modern loan servicing

Unlock your lending potential by efficiently servicing any class of loans and credit cards with deep API-first configurability and robust automation.

Problems with inflexible servicing products

Unscalable

Other solutions might work for a small portfolio, but their technical infrastructure fails with just a few thousand accounts.

Operational inefficiency

With lackluster automation tools, agents do everything manually, bottlenecking your operation.

Manual mistakes

Platforms lack guardrails or guidance, leading to costly user errors and fines for lack of compliance with regulations.

Driving operational efficiency with LoanPro’s Servicing Suite

Maximum servicing efficiency

Do more with less through streamlining servicing via automation, agents, and borrower self-service.

Compliance safeguard

Prevent malfeasance and automate required disclosures, keeping everything above board.

One platform

A single platform to improve agent, borrower, and back-office servicing experiences.

The value that 600+ lenders achieve through LoanPro

Increase operational efficiency

Increase agent productivity and decrease agent to loan ratios.

Increase customer retention & loyalty

Provide seamless and automated rules that service loans to delight your borrowers and build a life long relationship.

Reduce risk

Pre-built compliance rules embedded within our servicing suite to ensure you’re compliant 100% of the time.

Accelerate Loan Growth

Increase customer satisfaction that drives organic growth via word-of-mouth.

The tools you need for next-gen servicing

LoanPro’s suite of servicing and automation tools give you complete control over your portfolio without requiring constant user input.

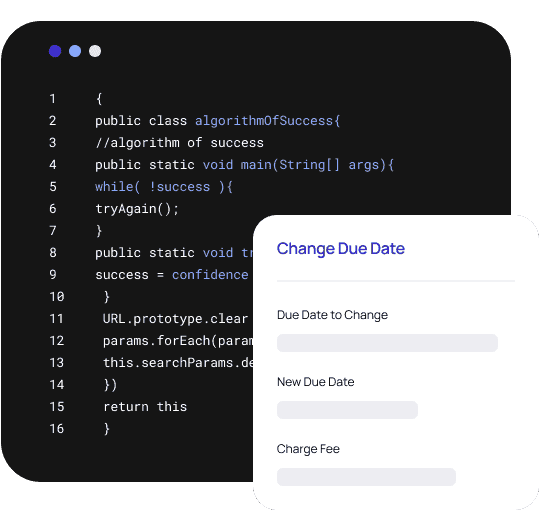

Agent walkthroughs

Cut down on training time and mistakes by guiding your agents through your processes.

Communications suite

Send out personalized notices, disclosures, and marketing materials with ease.

Comprehensive loan recasting

Backdate any adjustment to our real-time ledger and recalculations happen automatically.

Role-based access

Ensure that team members only have access to specified loans and features to avoid mistakes.

Agent walkthroughs

Cut down on training time and mistakes by guiding your agents through your processes.

Communications suite

Send out personalized notices, disclosures, and marketing materials with ease.

Comprehensive loan recasting

Backdate any adjustment to our real-time ledger and recalculations happen automatically.

Role-based access

Ensure that team members only have access to specified loans and features to avoid mistakes.

Automation engine

Automate every servicing action imaginable with configurable, rule-based automation.

Reporting suite

Comprehensive reporting functionality to automate all regulatory, investor, and internal reporting requirements.

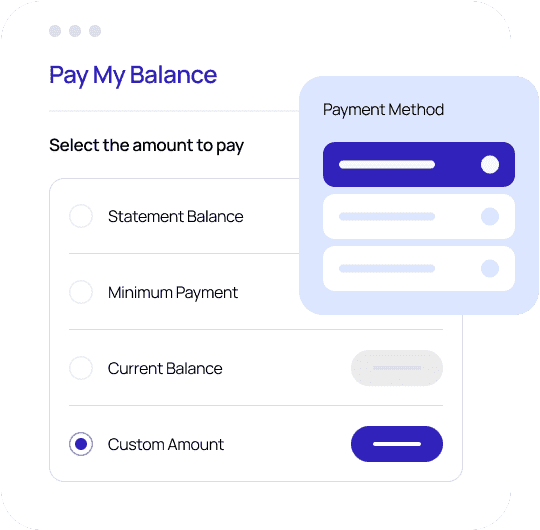

Borrower portal

Empower your borrowers with self-service options for their loans to increase operational efficiency.

Automation engine

Automate every servicing action imaginable with configurable, rule-based automation.

Reporting suite

Comprehensive reporting functionality to automate all regulatory, investor, and internal reporting requirements.

Borrower portal

Empower your borrowers with self-service options for their loans to increase operational efficiency.

Automation engine

Automate every servicing action imaginable with configurable, rule-based automation.

Reporting suite

Comprehensive reporting functionality to automate all regulatory, investor, and internal reporting requirements.

What our 600+ customers say about LoanPro

Chief Operating Officer

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

Operations Platform Owner

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

Chief Operating Officer

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

The robust API-first servicing platform

API-first platform

- Configurable end-to-end platform.

- Workflows that put you in control.

- Create unique and differentiated loan and credit programs seamlessly.

Multiple servicing channels

- Agent tools to quickly complete any servicing task.

- Robust automation engine that runs servicing tasks in the background.

- Borrower self-service optionality with any servicing task.

Ultimate flexibility and scalability

- Comprehensive loan recasting to avoid painful mistakes.

- A platform that supports virtually every class of loans, leases, and credit cards.

- The only API-first platform proven for scalability with over 25 million loans on platform today.

Additional components of LoanPro's unified credit and lending platform

Modern Lending Core

A reliable foundation that tracks all lifecycle events in our real-time ledger while using Compliance Safeguard to keep you in line with updated regulations.

Collections Suite

Provide payment flexibility and hardship programs for customers who are past-due on payments.

Payments Suite

Setup AutoPay and provide ultimate payment flexibility with any payment method imaginable that’s supported in LoanPro.

Origination Suite

Ensure interest rates and disclosures are correct and use our workflows to orchestrate the highest converting path for applicants.

Upgrade your lending and credit servicing with LoanPro.

Talk with our team about your organization’s servicing operations today.