What is CECL? Your guide to the Current Expected Credit Loss Standard

Introduction: Why CECL is now central to modern lending

The 2008 financial crisis exposed a critical weakness in the financial industry: reliance on backward-looking accounting methods that masked massive risk. In response, regulators enacted new rules to future-proof the industry.

One of the most profound changes is CECL (Current Expected Credit Loss). This article tackles what is CECL, why it matters to your financial organization, and what continuous CECL compliance entails today.

The key takeaway is this: present security doesn't equal future stability. Companies in the financial industry need to deeply understand risk to safeguard their business against economic uncertainty. To encourage this, the Financial Accounting Standards Board (FASB) published the new CECL accounting standard. Indeed, research published by the Federal Reserve Board shows that the new standard pushes institutions to produce higher-quality information, leading to loan loss provisions that better reflect future local economic conditions.

CECL in a Nutshell: What is CECL and what is CECL in accounting?

What is CECL? It is an accounting standard that replaces the outdated Incurred Loss (ICL) model. Essentially, CECL mandates that financial institutions record "life of loan" loss estimates at the time of loan origination or purchase.

- The Core Change: CECL requires organizations to calculate potential losses using a predictive and forward-looking model that considers historical data, current conditions, and reasonable and supportable future forecasts.

- The Authority: FASB introduced the CECL accounting standard (ASC Topic 326) in 2016. It changed how banks and other organizations estimate allowances for loan and lease losses (ALLL) by explicitly requiring forward-looking data.

- The Scope: To ensure full CECL compliance, you must estimate credit losses over the entire "contractual term," from origination right through to servicing.

This requirement is a fundamental departure from legacy Generally Accepted Accounting Principles (GAAP), which delayed the recognition of credit losses due to the use of the incurred loss model.

CECL Deadlines and Applicability

While large public filers adopted the standard earlier, the final compliance deadlines for nearly all other entities have passed:

- Smaller Reporting Companies (SRCs), Private Entities, and Not-for-Profits: CECL became effective for fiscal years beginning after December 15, 2022. This means compliance was generally required for 2023 calendar year-ends and beyond.

- CECL for Nonprofits: All entities complying with GAAP must adopt CECL, including many nonprofits with relevant financial instruments (e.g., certain trade receivables).

Why CECL compliance is crucial for CECL banking and lending

The idea behind CECL is to encourage every CECL banking institution and online lender to proactively account for unforeseen economic changes that affect risk calculations on financial assets.

Before CECL, banks looked only at past credit losses, which proved ineffective during a global crisis. CECL compliance forces a more dynamic approach:

- Earlier Loss Recognition: Losses are recognized immediately upon loan inception, providing a more timely and accurate reflection of credit risk.

- Granular Segmentation: Companies must group assets according to risk profile (not just type) for proper segmentation and analysis.

- Future-Proofing: The requirement for forward-looking forecasts empowers institutions to make necessary adjustments now to prepare for future financial downturns.

This is why federal regulators continue to monitor CECL requirements closely, expecting institutions to demonstrate ongoing maturity in their models and documentation.

CECL methodology and CECL calculation

The FASB's CECL guidance does not suggest a specific CECL methodology; rather, it offers flexibility for financial institutions to choose a CECL model that best suits their portfolio and risk profile. You may even use multiple methods across different asset segments.

Below are five recognized CECL methodologies you can use for your CECL calculation:

- Roll-Rate (or Migration Analysis): This methodology segments assets by delinquency status. The CECL model determines the roll-rate by calculating the percentage of account balances that migrate from one delinquency stage to the next succeeding stage.

- Probability of Default (PD) Methodology: This is an advanced CECL calculation that requires three values: the likelihood (probability) that a loan defaults, the incurred loss given default (LGD), and the exposure at default (EAD). These values are multiplied to compute the expected credit losses.

- Loss-Rate: This method segments financial assets according to risk profile and calculates a historical rate of loss for each segment using past data. This rate is then adjusted to reflect current economic conditions and reasonable and supportable future expectations to determine the expected credit loss.

- Discounted Cash Flow (DCF): To compute this, you estimate the future cash flow of the asset based on its current value. You then discount this amount at the loan’s effective interest rate. Subtracting this figure from the amortized cost basis determines the allowance for credit losses.

- Aging Schedule: This method is primarily used for trade receivables. It forecasts the allowance for delinquent debt by determining how long a receivable is past its due date (its age category). The greater the age of the receivable, the higher the corresponding historical loss rate becomes in the forecast.

If your portfolio is diverse, you might decide to use more than one CECL methodology across different segments. CECL model validation and rigorous documentation remain essential, regardless of the method chosen.

How to maintain CECL compliance with CECL software solutions

Since the CECL regulation requires a much deeper and more complex loss modeling and analysis, managing it without specialized tools is nearly impossible. This is where CECL software becomes indispensable.

CECL data management is job one

The foundation of any successful CECL implementation is data. You need a system capable of storing current and historical data (often going back ten years) for both bad and good loans to assemble a credible forward-looking model. If your internal historical data is insufficient, you may need to look for external data sources such as Federal Reserve Economic Data (FRED), which you can use as reference points to help make sense of your information.

- The challenge: Institutions struggle with comprehensive CECL data management and achieving the necessary granularity.

- The solution: Modern, API-first lending platforms act as a single source of truth, automating data collection and making it readily available for your CECL software solutions.

Focus on continuous CECL reporting and validation

Post-implementation, the focus shifts to maintenance and revision. In 2024, federal regulators continue to scrutinize CECL processes, specifically flagging inadequate support for, or identification of, qualitative factors (Q factors) during examinations.

- Model validation: You must continually validate the CECL model you use to sustain the accuracy of your results and ensure they capture the full credit risk.

- Disclosure requirements: Ensure you meet CECL disclosure requirements with transparent, auditable reporting that supports both internal and external audits.

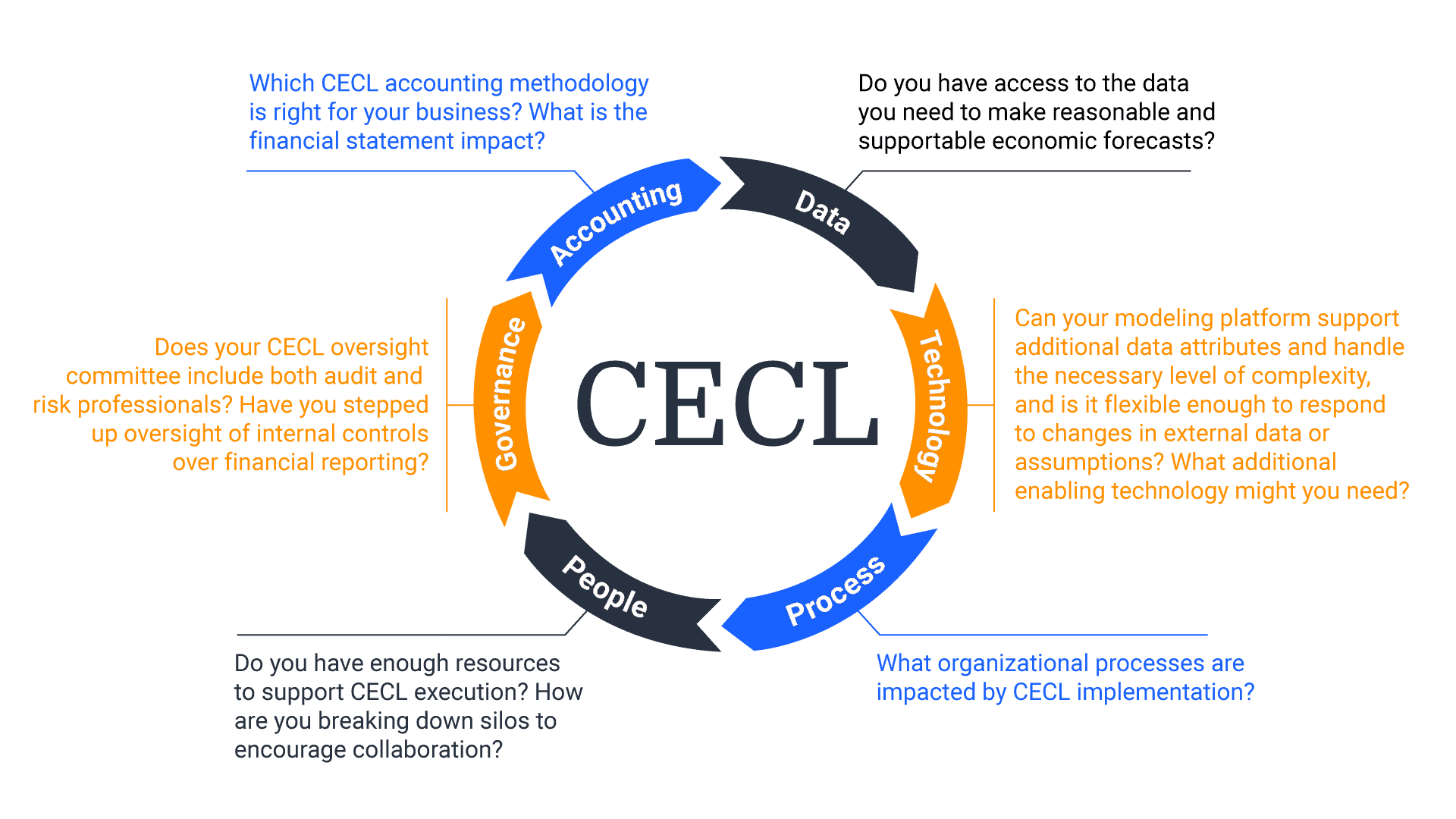

Leverage CECL solutions and early adopters

Researching institutions similar to yours that have already implemented CECL can provide valuable insight. By focusing on CECL solutions adopted by others, you can avoid common pitfalls, such as inadequate support for qualitative factors flagged by regulators. Reference the image below to see a framework used for successful CECL implementation.

Image of a chart showing the CECL process

Conclusion

The CECL accounting standard is now fully in effect for most entities. CECL implementation is an ongoing process that requires continuous effort, data management, and model refinement.

Success starts with proper data collection and organization. If you have loan servicing data that you need to organize and track properly for your CECL data management, you’ll need robust CECL software to get the job done.

LoanPro's platform helps manage the entire loan process via automated payoffs, collections, and lifecycle monitoring. Our system tracks everything in the loan servicing stage, providing you with the clean, granular data required to help build and maintain your CECL model.

Ready to fortify your CECL data foundation? Click here to read more about LoanPro's modern lending and credit platform in action.