LoanPro’s Monthly Product Update – August 2023

Innovation is the center of everything that we do as we continually improve our API-first modern lending platform. The month of August was full of over 100 product releases to our platform, and this monthly blog post will give you the highlights.

Our product roadmap is prioritized through input from our Customers with a focus on LoanPro’s commitment of “Customer Delight”. If you’d like to discuss any of these improvements further, please schedule time to connect with our team.

Now let’s dive in!

Highlighted Features

As we continually innovate, it’s important to remember the foundation of LoanPro’s API-first lending platform. As a result, every month we’ll call out four of our most valuable features that exist within our API-first lending platform.

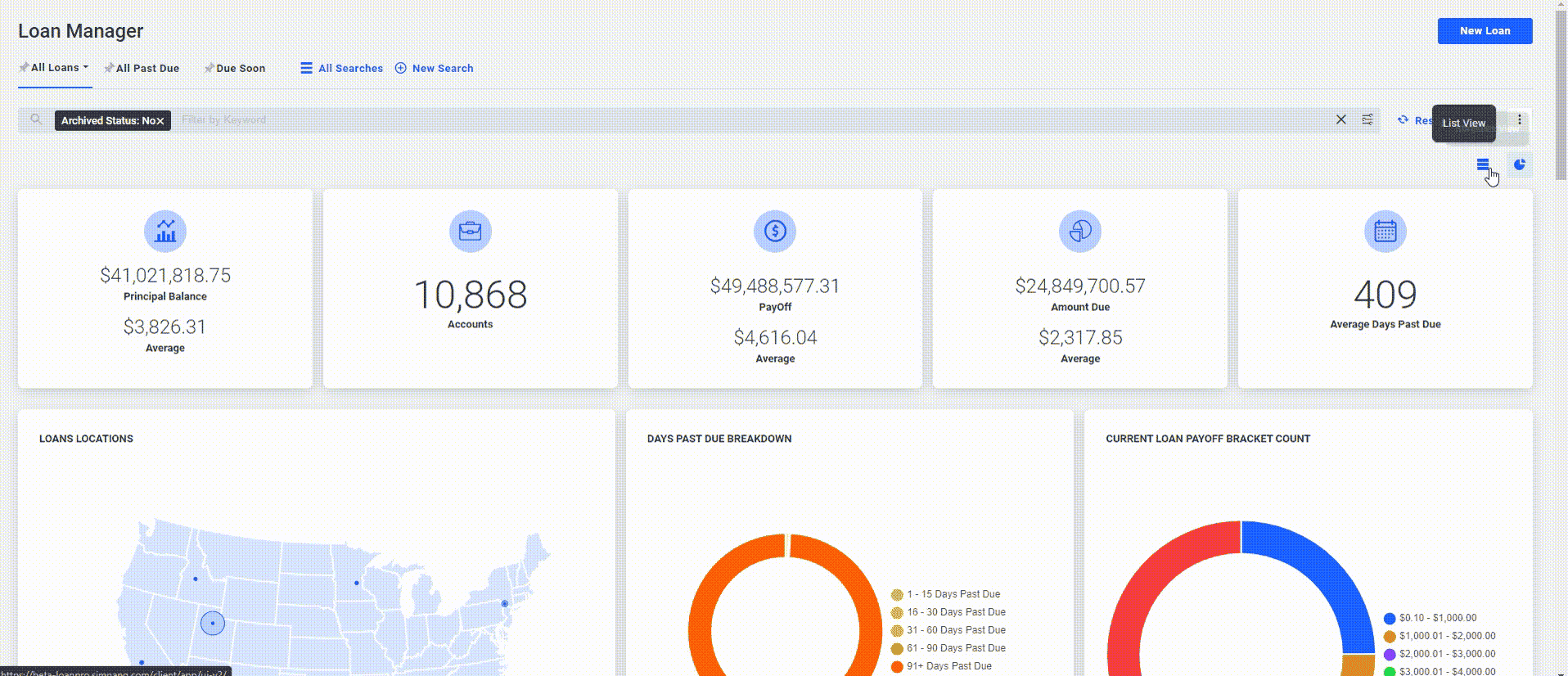

LoanPro’s Updated Loan Manager

In June 2023, LoanPro launched our completely redesigned loan manager that has simplified the process of searching for and servicing loans. Customers who are using our new loan manager have reported faster speed to resolution times and increased first call resolutions from frontline staff.

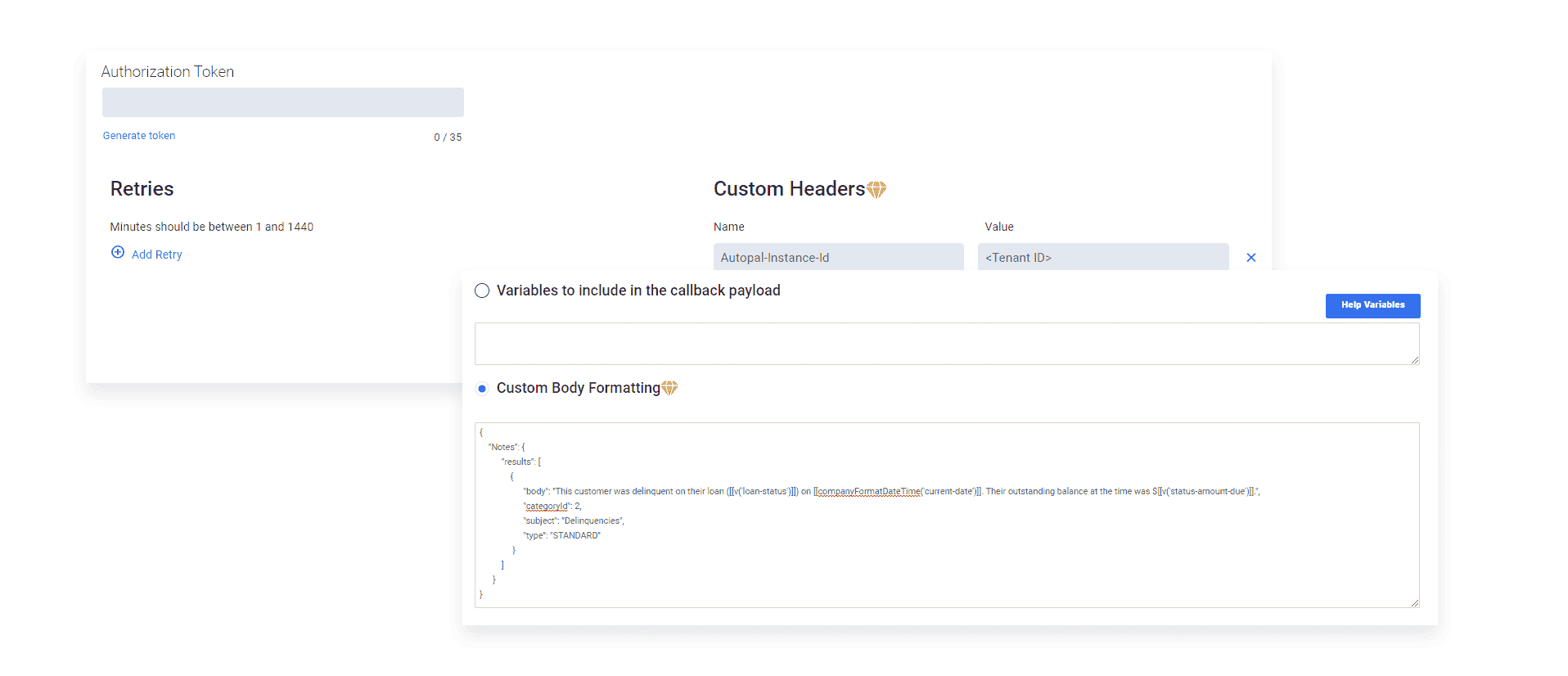

Webhooks & Automated Retries

LoanPro’s webhook functionality empowers our customers with the ultimate flexibility and configurability. With webhooks, our customers are able to update external systems and change anything within LoanPro’s loan management system when specified criteria are met. In LoanPro, you’re able to configure as many webhooks as you’d like to complete any action imaginable.

Additionally, retries can be configured when a webhook does not reach its desired destination. LoanPro allows you to set up to 50 retry attempts and configure how long to wait between attempts.

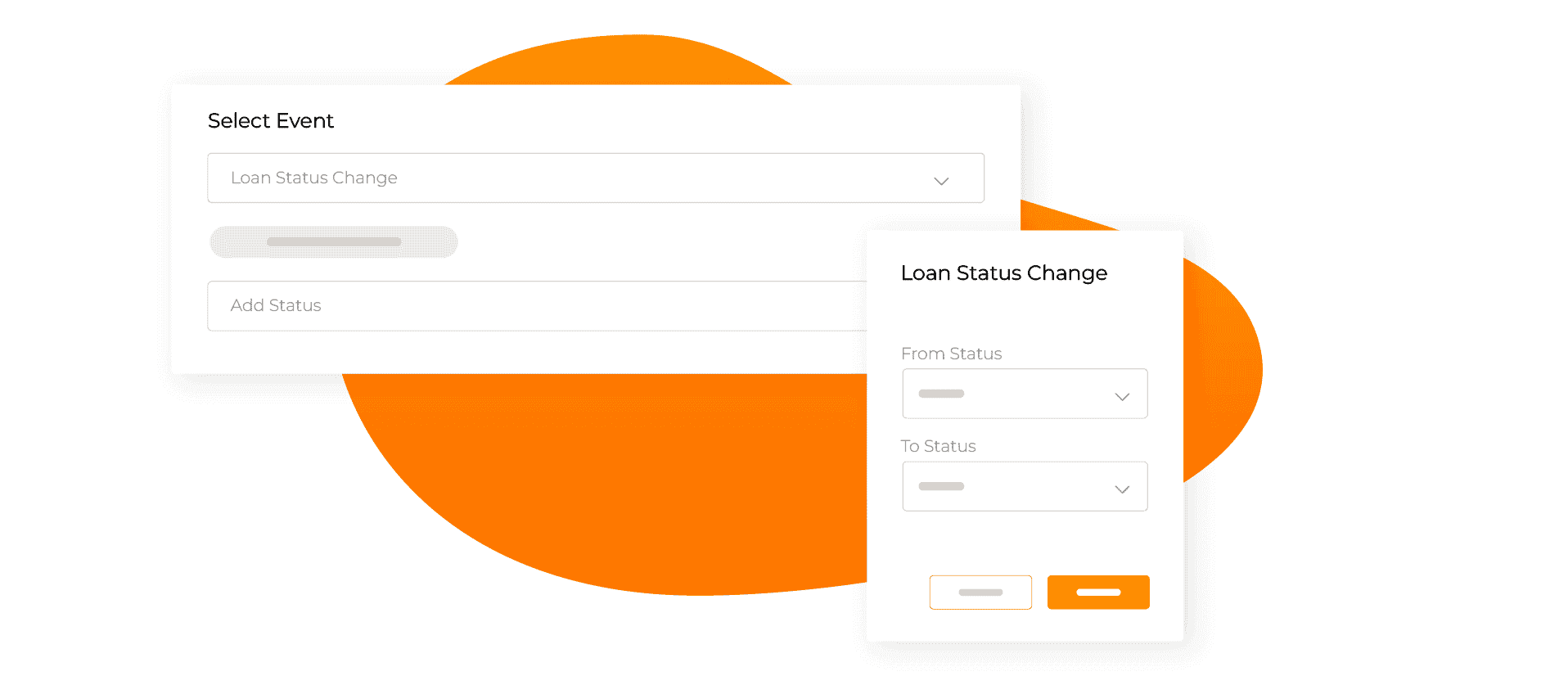

Event Based Notifications Updates

LoanPro allows our customers to send out notifications to their borrowers when specific events occur. With the ultimate configurability in mind, we made two enhancements to our event-based notifications:

- Creating multiple notifications all triggered by the same event. Use cases include sending different emails to borrowers, co-borrowers, and agents; sending out communications through multiple channels; and much more.

- Generating event-based communications based on daily maintenance status to update borrowers.

Sending ACH and Card Funding Transactions through RePay

Borrowers want the most flexible payment options possible to meet their needs where they’re at, especially when they’re struggling to pay. Through LoanPro’s integration with payment processor RePay, borrowers are able to make loan payments via either a debit card or ACH account driving higher repayment rates and lower default rates.

Enhancements to Existing Capabilities

As we listen to our customers and strive for customer delight, we’re constantly making improvements to existing functionality that accelerates growth and increases operational efficiency for our customers. The deep-dive below represents significant improvements that were made in August from import system improvements to SSO login enhancements.

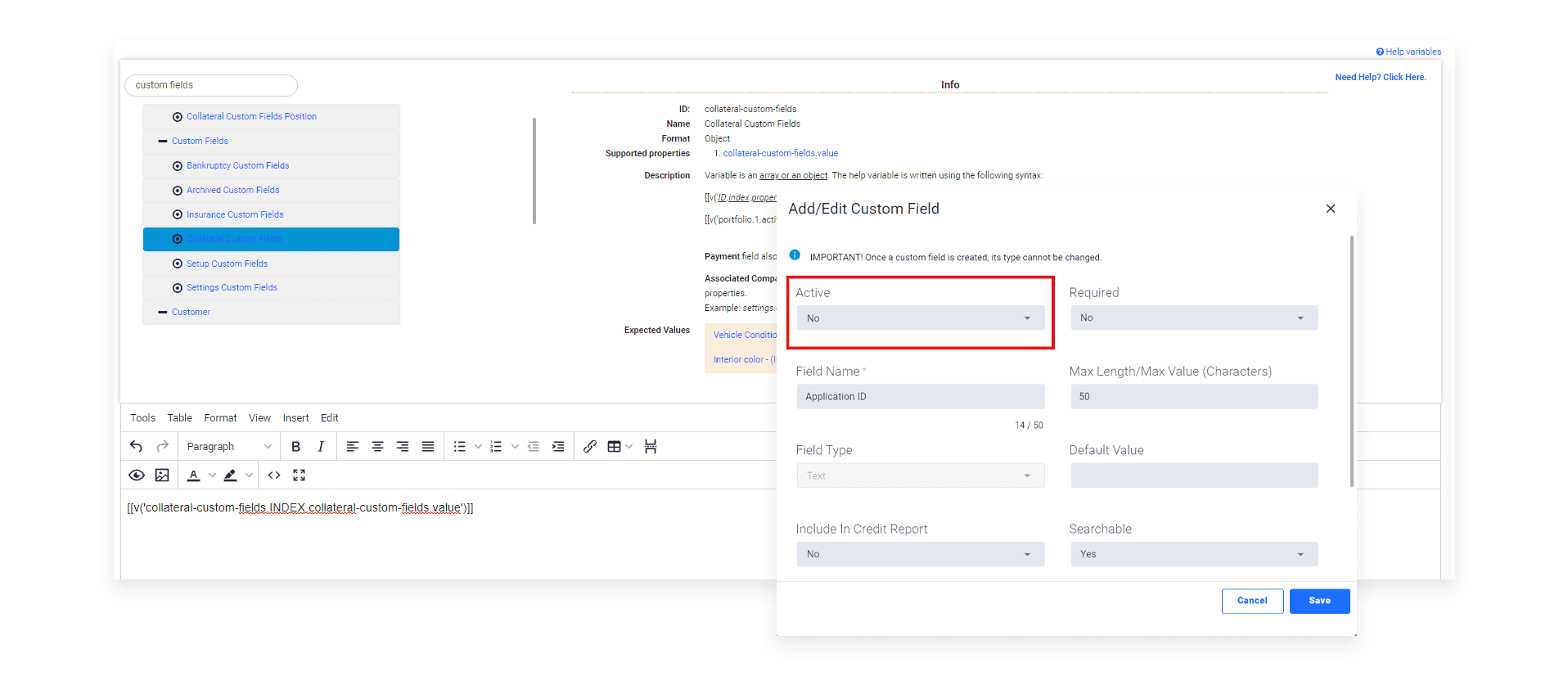

Increased Flexibility for Custom Fields

The ability to not only create custom fields within a loan management system, but also to have them function like native fields is one of our customer’s favorite capabilities of our platform. With custom fields, any configuration is possible. We are continuously enhancing Custom Fields functionality to drive even greater value. In August, we released the following enhancements:

- Improved and enhanced the ability to include Custom Fields in various automatically generated Scheduled Reports.

- Support the ability to hyperlink the URLs associated with Custom URL Fields. This means you can show clickable, user friendly text in place of a full URL, making it more easily digestible for agents.

Update to Multiple Collateral imports

LoanPro is the only API-first lending platform that can accommodate collateralized loans, and we even support the ability to attach multiple pieces of collateral to a loan (e.g., using a vehicle and a trailer as collateral on a single loan). Historically, collateral has been created and updated via our API or through the user experience of our loan management system. To provide greater flexibility to our customers, multiple collateral can now be both created and updated via csv import as well.

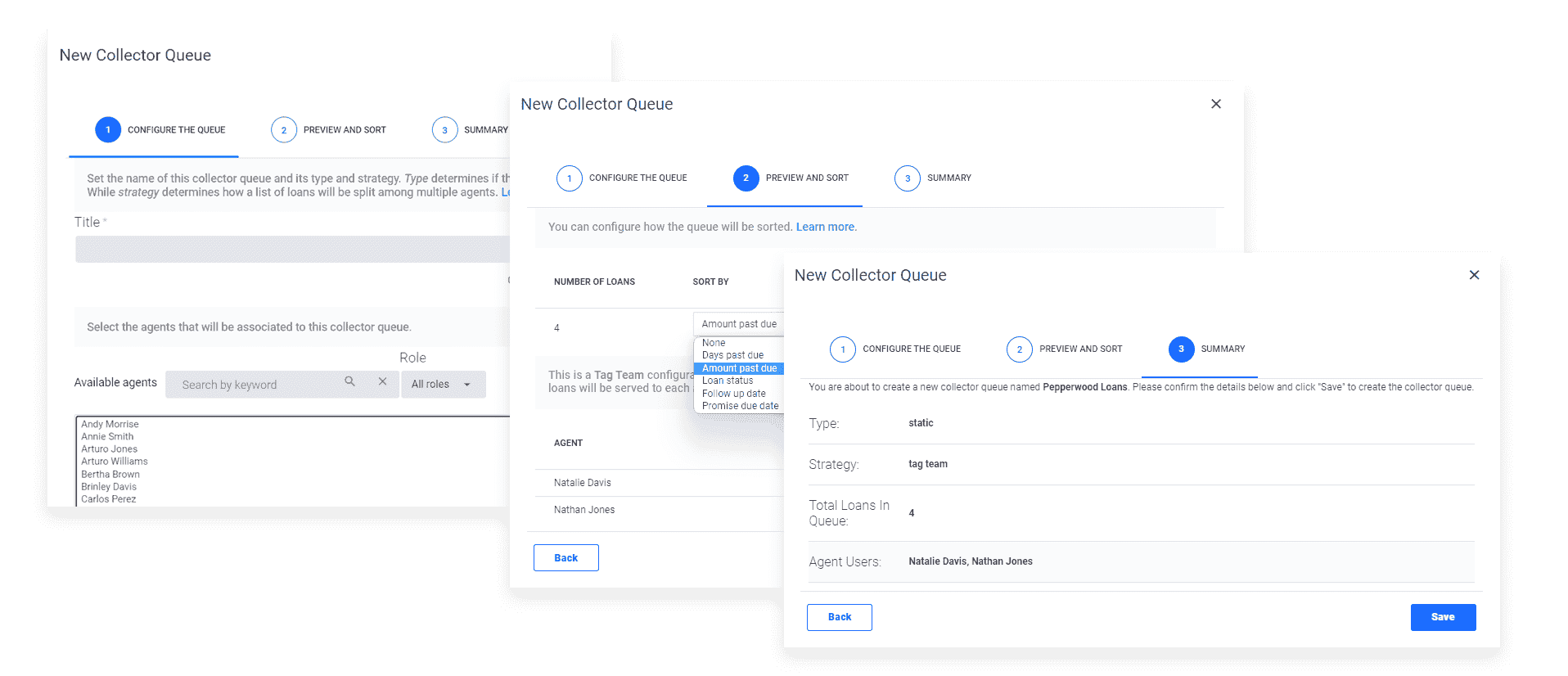

Collector Queue Summary Data

All lenders want to increase productivity of their frontline staff and searching for loans in a loan management system can be one of the biggest distractions.

LoanPro’s collector queue functionality enables our lenders to assign a group of loans to specific agents, eliminating the need for agents to manually search for individual assigned loans. Instead, frontline staff work through their assigned loans like they’re working on a task list. This feature significantly cuts down on wasted time and has helped our customers to increase their agent to loan ratios.

In August, we launched the ability to export summary data from the collector queue which includes a breakdown by agent of all accounts they worked on and the results for each account. This enables more efficient and streamlined reporting for all of your collections efforts while using our collector queue functionality.

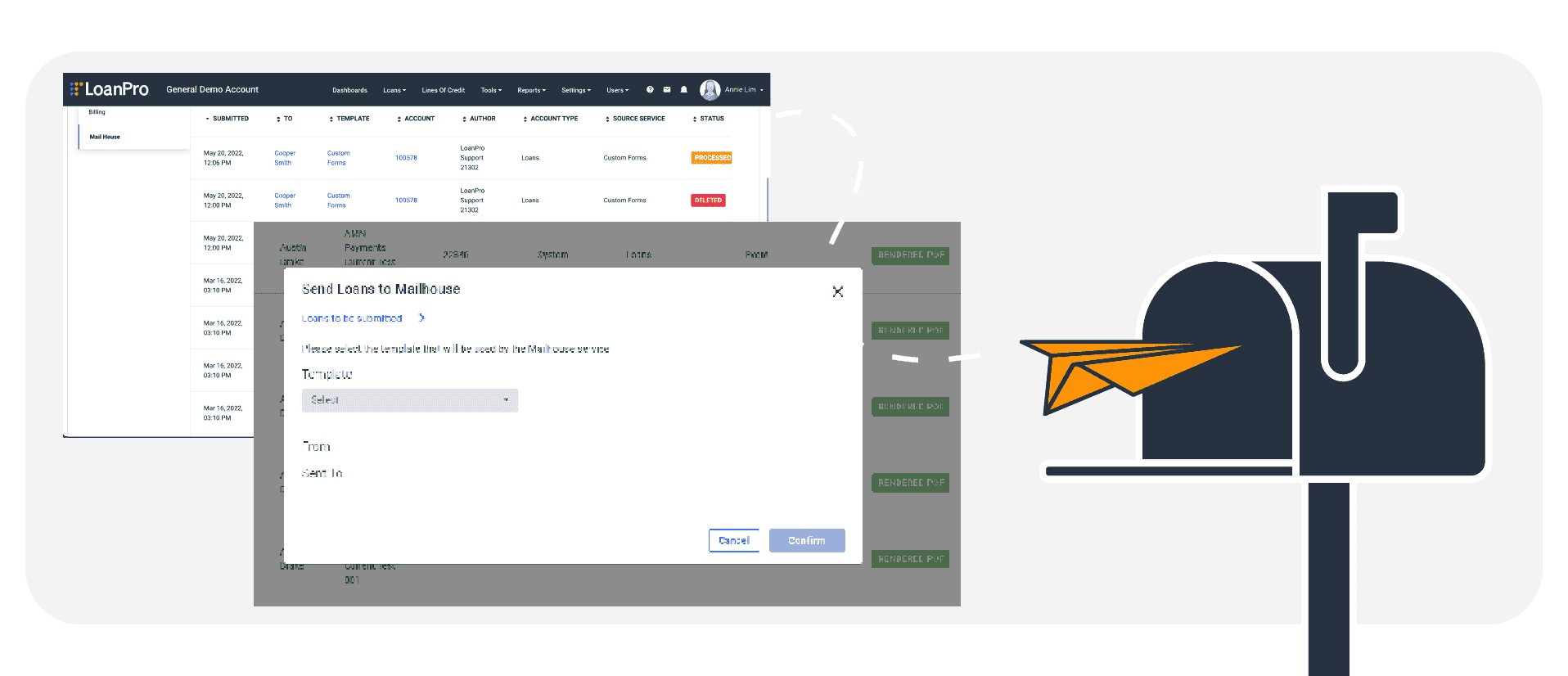

Storing Historical Mailed Documents and Statements

LoanPro’s Mail House tool provides the ability for our customers to send physical mail automatically from their loan management system. While these historical records were previously stored with a third-party partner, all historical documents are now stored directly within LoanPro’s Connections product.

This enables easier and faster document retrieval for audits, customer requests, or any other needs that our customers have with these documents.

Single Sign On (SSO) Login Enhancements

Providing a best-in-class agent experience is core functionality for LoanPro, as our customers see accelerated productivity from front-line staff when switching over to LoanPro. One core aspect of agent experience is making the authentication process into a loan management system seamless, which LoanPro accomplishes through our SSO integrations.

In the month of August, we were able to make several significant enhancements to our SSO integrations making it easier for our customers to use this functionality. This includes revamping our forgot password flow and authentication via API.

Increased Tracking for Audit Trail

LoanPro’s audit trail functionality empowers our customers to conduct a deep dive analysis to changes that were made on specific loans, which is tremendously useful during an audit or review process. Now, the audit trail is updated whenever a borrower uploads a document via a borrower portal. Our customers using our document upload functionality will see this change reflected in their audit trail immediately.

Compliance Updates

A core foundation of LoanPro’s API-first modern lending platform is driving compliance for LoanPro and all of our customers. LoanPro automates the compliance process to reduce regulatory risk for our customers, and in the month of August, we made the following improvements in relation to compliance.

CCPA Compliance

CCPA or California Consumer Privacy Act is intended to protect privacy rights for residents of the state of California. The act allows consumers to request companies to provide stored personal information, allows them to deny their information being sold, and provides the right to have companies delete all personal information.

We are thrilled to announce that CCPA compliance is now fully supported in LoanPro’s loan management system for agent users and borrowers. This compliance includes the ability to adjust whether data is sold, export any necessary information that’s requested from the borrower, and quickly delete requested data.

SOC 2 Type II and SOC 1 Type II Annual Reports Completed

SOC 2 and SOC 1 compliance are deep, external audits that are delivered in a detailed final report that closely examines a company’s information systems to ensure they meet the highest standards for information security.

Over the past month, LoanPro went through the recertification process that’s required annually and passed both annual reports. This in turn provides our customers confirmation from a reputable third-party that LoanPro has the appropriate controls in place to mitigate risks related to our products and services.

In short, our customers can rest assured that data security and privacy are core to everything that LoanPro does.

We are thrilled to announce that CCPA compliance is now fully supported in LoanPro’s loan management system for agent users and borrowers. This compliance includes the ability to adjust whether data is sold, export any necessary information that’s requested from the borrower, and quickly delete requested data.

System Performance

LoanPro has always maintained a 99.9+% uptime as we know that our customers rely on us for the infrastructure of their lending business. Consequently, we’re always focused on making improvements to our system performance to ensure we can always deliver on these high standards. Key improvements in the month of August included:

- Successfully migrated to PHP8, which noticeably increased response time in our heaviest applications, such as our loan calculator.

- Loan headers are now updated in real-time based on rules that are established in our agent walkthroughs to provide real-time servicing insights to frontline staff.

- Loan create now operates in a step function which increased the speed and supported volume for this function.

- Enhanced idempotency between LoanPro’s loan management system and secure payments that ensures the same result is always found regardless of the system.

Please reach out!

LoanPro has built the only scalable, API-first lending platform on the market that can handle every class of loan and these improvements are focused on driving positive business outcomes for our customers. If there are any improvements or integrations you’d like to see in the future, please let us know!