Improve Your Borrower’s User Experience with LoanPro’s Loan Calculator

A few months ago, one of our customers came to us with a problem: they needed a loan calculator that would enable borrowers to adjust loan terms using interactive sliders. The hope was that this easy-to-use calculator would help their prospective borrowers see how adjusting loan terms within a set range would affect their APR, payment amount, and total of payments.

To this customer, it seemed like a big ask. They had only used the loan calculator within our platform. They were unaware that LoanPro offers our calculator as a standalone service that was specifically designed for companies to build on.

The Solution: The LoanPro Loan Calculator

Calculating loans is the core competency of LoanPro, and this standalone calculator uses the same calculation engine that supports everything we do. As such, it has been tried and tested extensively for speed, accuracy, and scalability.

After meeting to understand the specifics, we provided the customer with access to our calculator service, so they could use it to:

- Take in loan terms

- Output payment amounts

- Perform APR calculations

- Create full amortization schedules in real time

Because our calculator was already built, already flexible, and already tested at scale, the customer was able to accelerate the project and go to market with their solution within six weeks.

The results were amazing. The customer had previously experienced a high abandonment rate of their online application. However, after implementing their user-friendly calculator, they quickly noticed a trend. Users who were spending time experimenting with their loan inputs were significantly less likely to abandon their loan applications. The increased understanding and financial literacy the calculator provided ultimately made applicants feel comfortable with pursuing a loan, increasing overall follow-through. There were also long-term effects on repayment. Borrowers who felt like they understood and chose loan values felt more responsibility to repay the loan after it was given.

Loan Calculator Build Vs. Buy

Any company that issues or intends to issue loans will probably ask the question, how will my loans be calculated? There are a few other questions that quickly follow. Things like:

- How will I ensure that my calculations match my loan contracts?

- How do I calculate APR to comply with Regulation Z?

- How do I ensure calculation accuracy?

- How do I stay flexible enough to avoid re-developing when changes are made?

- Who will head up this project?

- Should I build this myself, or does a solution exist that provides what I need?

With any technical endeavor, build versus buy is a common question. Do I spend the time and money it takes to have my developers create something from scratch, or do I buy something that someone else made, hoping it will fit all of my needs?

The build option usually comes with a lot of unknowns. In 2019, IT budgets increased by an average of 20% to accommodate platform modernization. Along with this, it was observed that:

- 52% of large IT projects went over time, over budget, or required a sacrifice of functionality.

- Harvard Business Review found that one in six IT projects has an average cost overrun of 300% and a schedule overrun of almost 70%.

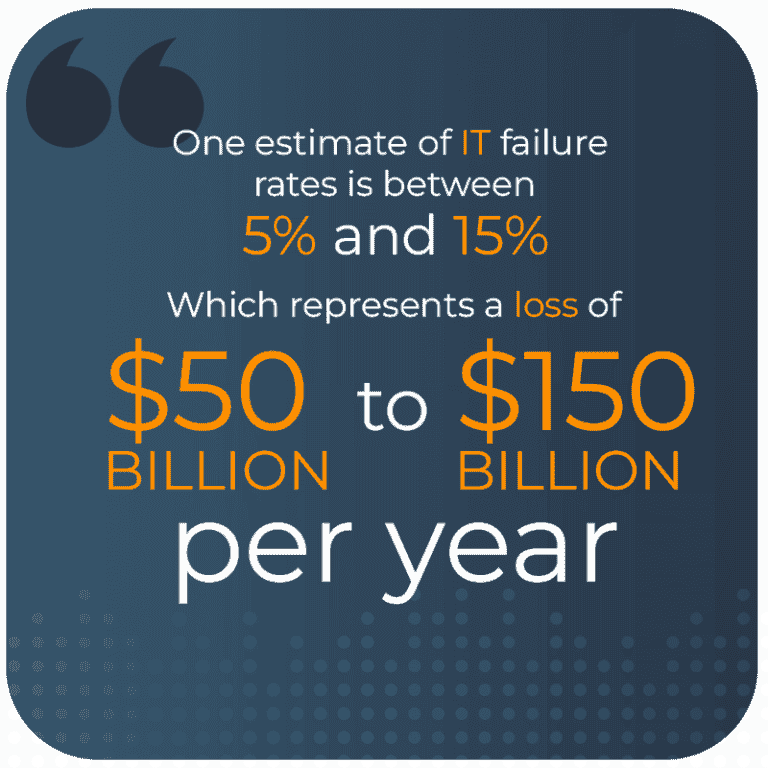

- According to McKinsey, 56% of IT projects fall short of the original vision. One estimate of IT failure rates is between 5% and 15%, which represents a loss of $50 billion to $150 billion per year in the United States.

One of the scariest outcomes of building things yourself is the cost of maintenance for the hardware and software required to run it. This could easily end up being more expensive than licensing fees for an established solution.

At LoanPro, we’ve worked with companies that have already spent and lost millions of dollars trying to create their own lending calculators. Working with a company that has tried to develop what we offer is our favorite kind of interaction. They are usually more excited about what we have, and more sympathetic about the time and cost they know it took to build it. These companies love that LoanPro provides the technical solution they were looking for as well as our knowledgeable people who can help implement it into their business.

The Advantages of LoanPro’s Loan Calculator

If you need an advanced loan calculator or are in the process of researching or building one, why would you choose LoanPro? LoanPro’s calculator is powerful and accurate, but it’s also flexible. It has been tested internally but has also been proven by millions of real-world loans for more than a decade. Our people understand many diverse lending models and specialize in implementing the LoanPro calculator for a wide variety of loan types.

Here are a few key highlights of our calculator service:

- Truth-in-Lending Act compliance

- APR calculation compliance

- Calculation options and flexibility

- Cloud-based, serverless architecture for speed and scalability

- Experienced people to help with the implementation

- Modern, REST-API-based connectivity

- A full range of features including calculation of TILA disclosure numbers, payment amounts, simple payment schedules, and full amortization schedules

If you are looking for a loan or APR calculator, before you build, or even if you’ve started building already, take a few minutes to talk with one of our specialists to determine if LoanPro’s calculator will accelerate the timeline and reduce the cost of your project.

Click below to schedule a meeting to learn more about how LoanPro’s calculator fits your needs.