How to Choose the Right Auto Lending Software

In the auto lending industry, numbers are everything. The more customers you lend to, the more revenue you can bring in. But, if you’re not working with a seamless loan management process, you’re never going to sustain a large number of borrowers, which means you’re not going to grow.

The reality is that there are many tedious, but important, tasks that suck up your time— from creating accounts and posting payments, to sifting through data to find the info you need. If you’re constantly in the weeds trying to manage your loans, you’re missing out on the revenue-earning potential that an optimized loan servicing process provides.

To help improve productivity, you need auto lending software that will do the heavy lifting for you. However, not every software suite is built the same so the one you choose needs to solve your workflow challenges.

Let’s dive into what you should consider when choosing the right auto lending software for your business.

Determine Your Priorities — What Do You Want Your Automotive Lending Solution to Help With?

As a bank, credit union, or auto financing department, your goal is to lend to as many borrowers as you can while comfortably managing the loans and ensuring a positive experience for customers. However, you might have specific challenges you need to overcome in order to reach those goals.

For example, if you want to increase revenue with loan protection products, you’ll need a solution that makes cross-selling simple. To improve the customer experience, automated notifications are a must. If your team relies on other applications to analyze customer data, integration features are a priority.

Here are some of the benefits and features that can help you solve challenges and achieve your goals faster.

- Cross-selling features — If your team has a set monthly sales goal for different products, you want software that has cross-selling functionalities. They allow you to market additional products to existing customers more efficiently. You can also monitor your cross-sell campaigns to determine which customers converted the most. From here, you can continue cross-promoting to the same customers and come up with new approaches to customers who didn’t convert.

- Automated workflows — If the bulk of your team’s time goes into menial tasks such as sending notifications, tracking payments, and leafing through data, you’re not as productive as you could be. By developing decisioning workflows using loan management software, you can reduce steps and save time.

- Frictionless loan processing for customers — You must make the initial process easy in order to generate more account openings. The right software can help you by allowing borrowers to apply for a loan via their mobile devices. It can also generate dynamic reports and other documents that the borrower can access at any point from the customer portal.

- Integrate multiple apps — If your organization relies on information from third-party tools and apps, you want software that helps you collect information from these data sources into a single location. You won’t have to check the data manually as you’ll have a single view.

You can narrow your search down with more specific goals from each of the points above. In doing so, you can determine the main obstacles your organization faces and then choose the best loan management software based on your needs.

Identify the Different Types of Auto Finance Software

Knowing the types of auto financing software available will help you decide the best solution for your organization.

Type #1: Loan Origination Software

The first is auto loan origination software. This type of auto financing software will help with the process of obtaining a loan, such as assessing credit risk during the screening process. A good loan origination platform ensures that your organization grants loans to the best possible borrowers.

Type #2: Loan Servicing Software

The second is auto loan servicing software, which is designed to help you collect payments from customers and distribute them to the involved parties.

A loan servicing solution solves problems such as dealing with late payments and ensuring customers have all the information they need to keep up with their loans. It makes the process of loan management far easier for auto lenders and enables you to service hundreds or even thousands of loans with a small team.

This software will automatically contact borrowers if they miss a payment. It also provides options to get the borrowers back on track with their payments.

Do You Need Both?

Both loan servicing and loan origination platforms help you build closer relationships with customers.

But they are also different because they handle different parts of the lending process. When searching for the right auto lending software, you can choose a platform that offers features for both loan origination and servicing. You can also use separate platforms for both.

For auto lenders that outsource the origination process, you might only want a robust loan servicing solution.

From these two types of software solutions, you’ll be able to choose the auto lending platform that fits your business like a glove.

Decide What Else You’ll Need from Your Loan Servicing Software

As you have identified your priorities, you now should have a clear idea of what to look for in loan servicing software. At this point, you want it to possess certain features that will help you simplify tasks and efficiently manage multiple loans.

Below are some of the other possible data management features and traits that you and your team may also find useful:

#1: Makes Compliance Easy

Compliance is one of the biggest concerns among financial organizations. Failure to meet current regulations could result in a hit in your reputation and loss of customer confidence.

On top of the Federal Trade Commission (FTC) and the Office of the Comptroller of the Currency, you also have to stay on top of the various lending regulations pushed by state attorney generals to keep both traditional and alternative lenders in check.

Some of the loan compliance regulations enacted in the auto industry are:

- Equal Credit Opportunity Act (ECOA) prevents lenders from discriminating against applicants based on race, religion, sex, national origin, and color.

- Servicemembers Civil Relief Act (SCRA) gives military members the right to terminate a vehicle lease acquired within 180 days or extend its service period for more than 180 days.

- Truth in Lending Act (TILA) requires you to disclose in writing the details of the loan, including interest rate, monthly payments, and other details.

- Unfair, Deceptive, or Abusive Acts and Practices (UDAAP) protects customers from financial institutions and unscrupulous practices.

Typically, organizations manually underwrite service steps to ensure that the decision rules are compliant with the directives of each regulation. But the problem that arises from here is that human error could take place in between steps.

To avoid this issue, you can use your software to automate the execution of decision rules. This minimizes potential mistakes committed by agents.

#2: Has Automatic Credit Scoring

If your business deals with loan origination, credit scoring is a big deal.

Normally, the process of credit scoring is performed manually by analyzing credit bureau requests.

Most financial institutions refer to the Fair Isaac Corporation (FICO) and VantageScore as credit scoring systems. Each is different, but both involve various steps to help lenders compute potential borrowers’ credit scores. Similar to the underwriting process, scoring creditworthiness is subject to human error. As a result, your team might reject auto loan applications of people with good credit standing.

By using auto origination software, you can automate this process and complete this task faster and with fewer mistakes. The great thing about using automation in credit scoring is its ability to analyze behavior dynamically and reveal trends that can help predict the performance of the loan over time.

#3: Utilizes Risk-Based Pricing

Once your auto loan office computes a borrower’s creditworthiness, you must offer the appropriate loan terms and interest rates based on the score.

The goal of risk-based pricing is to protect private lenders and financial institutions from the possibility of borrowers not paying the loan on time.

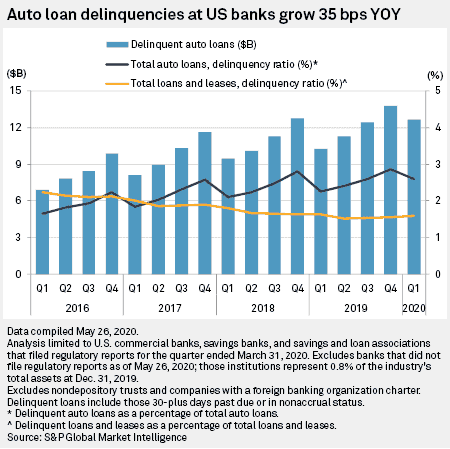

There has been a steady increase in auto loan delinquencies, especially in 2020, due to the spread of COVID-19 and the continued issues borrowers have regarding successfully recovering from forbearance programs.

Risk-based pricing considers the borrower’s ability to pay back the loan over a reasonable period according to several factors such as income and employment status.

That said, coming up with reasonable loan terms and conditions could be time-consuming. Agents will have to juggle these different variables to come up with just and accurate agreements among borrowers.

With dedicated loan managing software, you can get more precise risk-based pricing for each of your potential customers at a fraction of a time.

#4: Lives in the Cloud

Some banks and financial institutions are still using on-premises loan servicing software. Their reason is either they are happy with their current set-up, or they don’t know how to migrate their data from their existing software to a cloud-based one.

The problem with on-premises solutions is your organization will miss out on the ease of use, security, and cost-efficiency of cloud-based loan management software. It can also be more difficult to scale.

Cloud solutions are more efficient and more flexible. Plus, because the software is managed by your cloud provider in off-site data centers, your organization doesn’t have to worry about investing in and maintaining on-premises hardware.

In the long run, cloud-based software as a whole is the way to go compared to on-premise software. So, the sooner you can make your move, the sooner you can enjoy the benefits and convenience of an online solution.

#5: Developer-Friendly API

Let’s say you have narrowed your choices down to a handful of tools that you want to use.

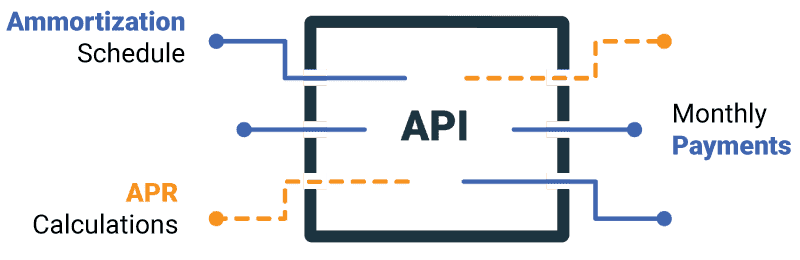

The problem is that none of the tools are comprehensive enough to offer you all the features you want from the software.

In this case, you want a loan platform with an application programming interface (API). It allows you to seamlessly connect the platform with third-party apps.

This way, if the software doesn’t have all the features you want from it, you can use its API capabilities and connect it with the current tools you’re using. You can then further simplify your loan management process workflow by gathering the necessary data from different sources.

This flexibility empowers you to get the most out of your auto lending software so you can reach all those revenue-growth and customer experience goals.

Conclusion

Choosing the right auto loan management software is crucial to the success of your business. By sending out automatic notifications and scheduling loan collections on time, you can run a tight ship, which will help your team and your customers.

If you’re still searching for the best loan servicing software out there, try out LoanPro for 30 days. You can automate virtually any loan management task you need so you can improve productivity and efficiency and boost revenue.

More importantly, its API allows you to create an auto loan management system customized to your needs. You can integrate multiple tools to simplify your workflow and get everybody on the same page.

Schedule a demo today and discover how effective your auto lending business can be with the right solution.